U.K. fintech Starling could be lining up a $4 billion IPO either in London or New York as revenues continue to climb.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Getting Ready

According to an article in the Sunday Times, Starling has created a holding company to own its banking business and an intermediate holding company which meets Bank of England rules on banks’ financial safety.

This is thought by analysts to be a strong signal that it is preparing for an initial public offering.

“It’s fair to say that, in the medium term, it’s desirable for Starling to be a plc,” said one source in the article.

London is thought to be a frontrunner for any IPO of the business, which was reported to be seeking a £4 billion valuation during a recent fundraising. However, the company’s chief financial officer, Declan Ferguson, told the Financial Times this year that it would consider a listing in New York.

Starling is aiming to grow in America through its software business, known as Engine, which allows banks to power their activities in the cloud.

It is currently used in Romania and also by the Australian financial services firm AMP, as well as powering its own app in Britain.

U.S. Potential

Another option could be a dual-listing on both sides of the Atlantic.

Its fellow U.K. fintech Revolut is reportedly eyeing up a unique dual-listing in New York and London as part of its potential $75 billion IPO.

If that deal took place, then it would be one for the history books as it would mark the first time a company had simultaneously listed in New York and entered London’s flagship FTSE 100 index.

Revolut has 60 million personal customers around the world and over 500,000 business customers.

In comparison Starling has 4.6 million customer accounts. Its annual revenues for 2025 rose to £714 million, up from £682 million the previous year.

IPO Comeback

After an April slowdown because of fears over President Trump’s trade tariff, as well as economic and geopolitical uncertainty, IPOs have come back to the boil. That could be down to the resilience of U.S. markets or pent-up demand from investors.

This year has already seen several large and successful IPOs from companies such as AI platform CoreWeave (CRWV), – see above – blockchain platform Circle Internet Group (CRCL) and fintech Klarna (KLAR).

What Other IPOs are on the Way?

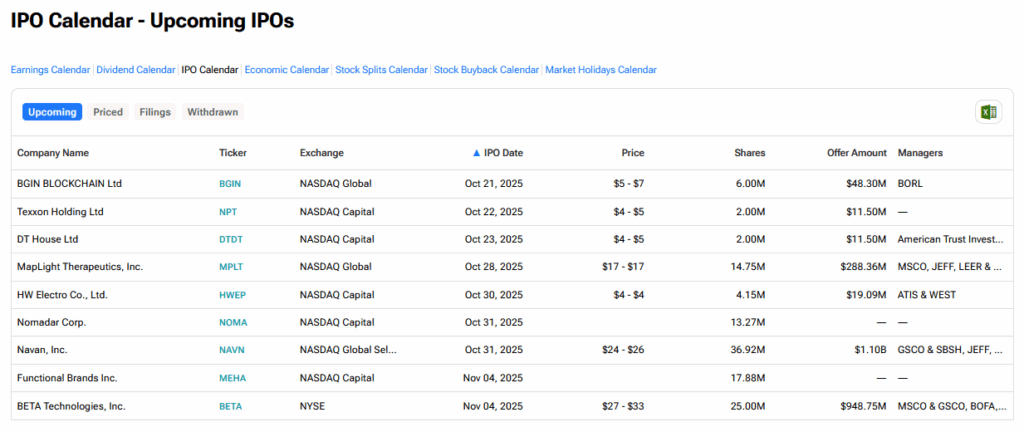

Let’s look at what other IPOs could be heading our way using the TipRanks IPO Calendar.