While the ASX surged following the RBA’s softer-than-expected interest rate rise, Tyro Payments Ltd. (AU:TYR) shares were down more than 2%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The stock earlier fell almost 2.6%, after the company announced a major shakeup to its executive team. Jonathan Davey took over as Tyro CEO on Monday, replacing Robbie Cooke. In addition to resigning from the top executive job, Cooke also left Tyro’s board.

Cooke agreed to stay on for an advisory role until the end of the year to assist with a smooth transition.

While Cooke may be stepping down, he remains heavily invested in Tyro, owning more than 891,000 shares in the company. Moreover, the outgoing executive has options to purchase additional shares in the company.

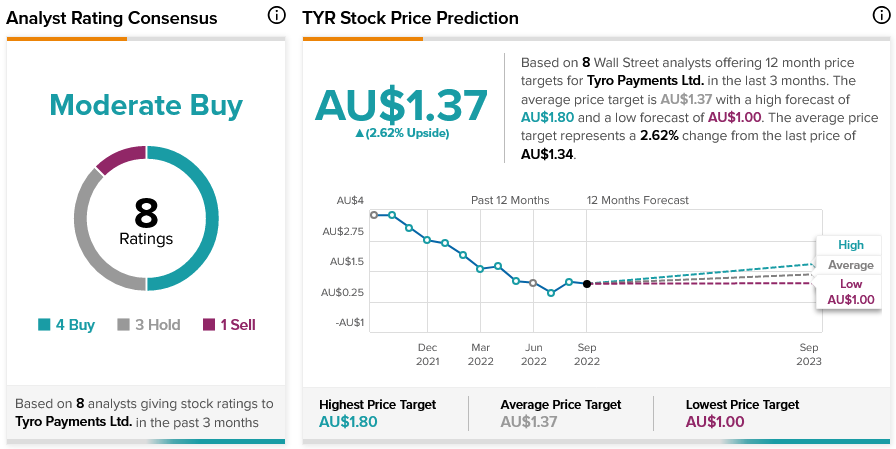

Tyro Payments’ share price prediction

Tyro shares have more than doubled over the past three months, but they are still down about 55% from where they began the year. The shares surged after Tyro received an unsolicited buyout bid. The company’s board ended up rejecting the takeover bid.

According to TipRanks’ analyst rating consensus, Tyro Payments stock is a Moderate Buy. The average Tyro share price prediction of AU$1.37 suggests nearly 3% upside potential.

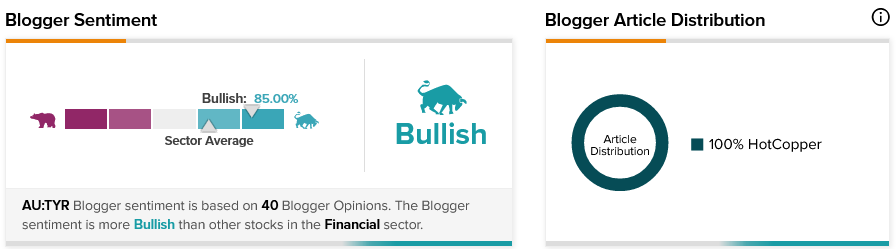

Tyro stock is receiving positive mentions on financial blogs. TipRanks data shows that financial blogger opinions are 85% Bullish on Tyro, compared to a sector average of 66%.

Closing remarks

Aside from processing payments for merchants, Tyro also provides merchant loans. Increasing interest rates can make the company’s lending business more profitable. However, Tyro could struggle with loan defaults and reduced payment processing demand if ongoing rate hikes cause a recession.

Despite the recession risk, Tyro has attractive long-term growth prospects, which may partly explain why it has become a recent acquisition target.