Deep-pocketed investors are out shopping and many have set their sights on beaten-down Australian technology stocks. Nitro Software (ASX:NTO), Tyro Payments (ASX:TYR), and Nuix (ASX:NXL) have emerged as favourite takeover targets in the ASX tech sector.

Nitro rejects takeover bid as stock shows modest upside potential

Nitro provides digital document editing and solutions software. The company received an unsolicited buyout offer of $AU1.58 per share from a group of institutional investors led Potentia late last month, worth around $AU400 million. Nitro’s board swiftly rejected the bid, describing it as an opportunistic offer that undervalues the company.

Nitro shares rose more than 6% last week, and the stock has jumped about 47% over the past month. Despite the recent surge attributed to the takeover interest, Nitro shares are still down about 30% year-to-date. According to TipRanks’ analyst rating consensus, Nitro stock is a Moderate Buy. The average Nitro price target of $1.80 implies about 6% upside potential.

Tyro Payments turns down buyout offer

Tyro provides financial solutions to merchants, with the package including payments processing and loans. Similar to Nitro, Tyro also received an unsolicited buyout offer from a group led by Potentia, this one worth $AU658 million. The group offered to purchase Tyro for $1.27 per share, but the company swiftly rejected the bid. Tyro’s board reviewed the bid and concluded that it undervalued the company.

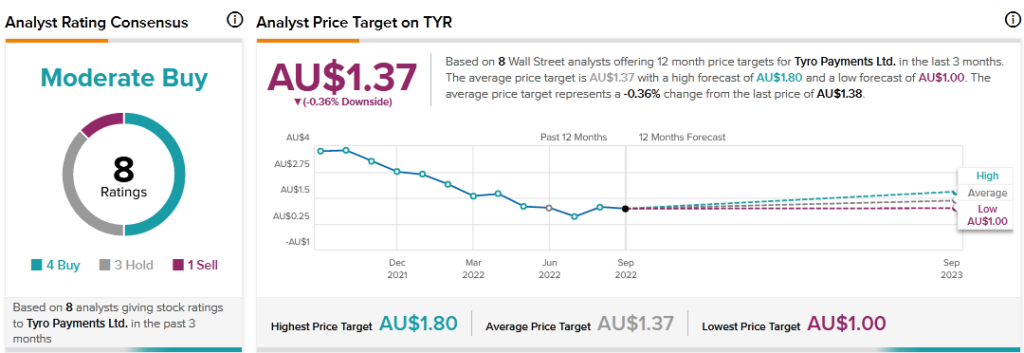

Tyro spiked on the takeover interest. The stock rose about 40% last week, but were still down more than 50% since the beginning of the year. According to TipRanks’ analyst rating consensus, Tyro stock is a Moderate Buy. The average Tyro share price forecast of $1.37 implies the stock is fully valued at the current level.

Nuix on Reveal’s radar for takeover

Nuix provides analytics and intelligence software to governments and corporate customers. The Australian newspaper reported that U.S. software provider Reveal is believed to be interested in acquiring Nuix. Moreover, Nuix has caught the attention of Relativity, another U.S. software provider, as a buyout target.

Nuix shares soared on the buyout rumours. Although the takeover speculation drove Nuix shares up more than 30% last week, the stock is still down more than 60% year-to-date. According to TipRanks’ analyst rating consensus, Nuix stock is a Hold. The average Nuix shares price target of $0.90 implies about 6% upside potential.

ASX tech companies respond differently to takeover offers

It remains to be seen whether Nuix will follow in the footsteps of Nitro and Tyro to reject a buyout bid if it lands on the table. Some ASX tech companies have responded favourably to buyout bids. For example, Nearmap (NEA) accepted Thoma Bravo’s takeover offer of $2.10 per share, for a total deal value of about $1.1 billion. ResApp Health (RAP) also accepted Pfizer’s (PFE) nearly $0.21 buyout offer.

Final thoughts

With share market values of ASX tech stocks dropping sharply this year, we we’re likely to see more takeover plays in the space. While some companies may be open for deals, others will see greater long term value in independence. As a result, some ASX stocks may become buyout battlegrounds that could lead to heightened volatility in share prices.