The gold price has been thrown a tariff-powered “lifeline” by President Trump, helping it soar to another record high.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Safe Haven

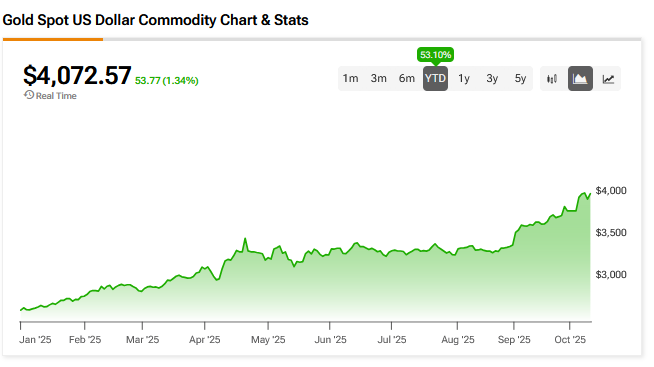

The spot gold price raced to $4,072 today after hitting a new peak of $4,078.05 during Asian trading. The main driver behind the surge was investors jumping back into gold as a safe haven as a result of President Trump’s sweeping new tariff moves.

On Friday he announced 100% tariffs on all Chinese goods and export controls on critical U.S.-developed software from November 1. The new rules were a tit-for-tat response to China’s recent restrictions on rare earth exports and specialized equipment.

Expectations of further interest rate cuts by the U.S. Federal Reserve also made gold look shinier. Indeed, markets are now pricing in an almost certain 25 basis-point rate cut at the Fed’s October meeting, with another expected in December, according to the CME FedWatch tool.

Peace Hopes

The gold price raced above the $4,000 an ounce mark for the first time last week but had slipped below that mark as a Hamas and Israel peace deal moved closer. Geopolitical fears like the conflict in the Middle East and Ukraine have been major drivers of the gold surge in 2025.

Investors booking profits also led the gold price lower before Trump gave gold a new lease of life.

“Just as it looked as if the U.S. and China were making baby steps to repair their relationship, Donald Trump throws a spanner in the works,” says Russ Mould, investment director at AJ Bell. “A new threat of high tariffs on Chinese goods coming into the US spooked investors in the East, with Asian markets showing a sea of red, following a similarly bad session for Wall Street last Friday. This new-found nervousness pushed investors back into gold, putting the shine back on the precious metal.”

Kathleen Brooks, research director at XTB, said “tariff fears have thrown a lifeline to the yellow metal. Trade tensions have driven more investor demand, even at these lofty levels.”

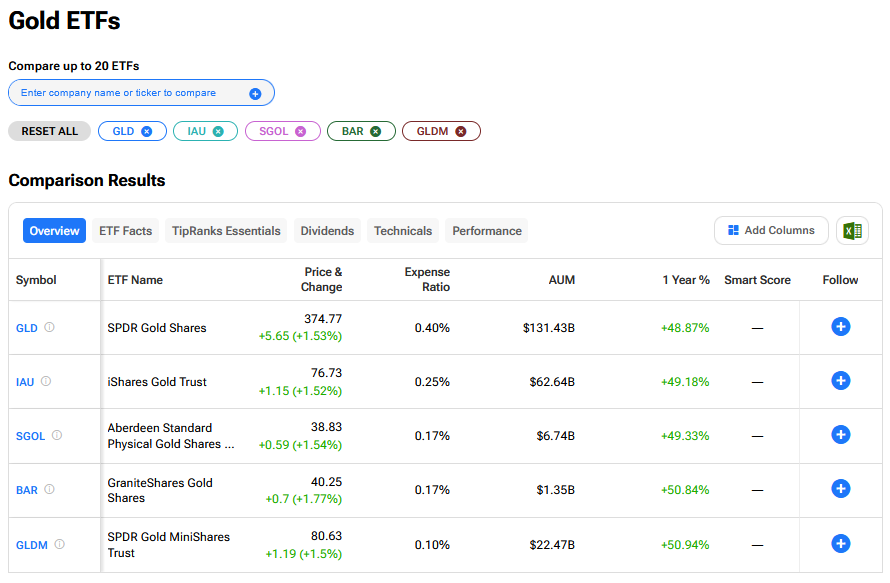

What are the Best Gold ETFs to Buy Now?

Investing in gold ETFs could be a good way of taking advantage of soaring prices. We have rounded up the best gold ETFs to buy using our TipRanks comparison tool.

.