Builders’ merchant Travis Perkins (GB:TPK) announced its third quarter update with an increase of almost 11% in its total sales and a 7.4% growth in like-for-like sales.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company, Britain’s biggest building supplier, benefited from a better mix of products and higher prices.

With its leading position in the industry, the company was able to pass on the higher costs to its customers. This helped it to offset the decline of 5.6% in the total volume.

Business divisions Merchanting and Toolstation saw growth of 11.5% and 6.1%, respectively.

The merchanting segment saw some decline from the slowdown of demand from smaller trade customers but was offset by the order growth from large builders.

The Toolstation division is all set to roll out around 80 new branches in 2022 in the UK and Europe. This will provide a further boost to the European business, which saw a sales growth of 23.3%.

Nick Roberts, the chief executive, commented, “We continue to benefit from our diverse end market exposure, from small independent builders through to large contractors delivering national infrastructure projects. “

Russ Mould, investment director at AJ Bell had a different opinion on the results. He said, ‘Traditionally, a key sales catalyst for building product suppliers has been people moving house as they want their new home to look smart. So, while Travis Perkins’ latest update provides some relief that the sector is not grinding to a halt, it is by no means in safe territory.’

The stock was trading up by almost 2% during the day, having fallen by 48% in this year.

What does Travis Perkins Plc do?

Travis Perkins is the UK’s leading building materials and equipment provider to the construction industry.

The company operates through more than 700 branches and includes brands such as Toolstation, BSS, Keyline, CCF, and Travis Perkins.

Is Travis Perkins a good buy?

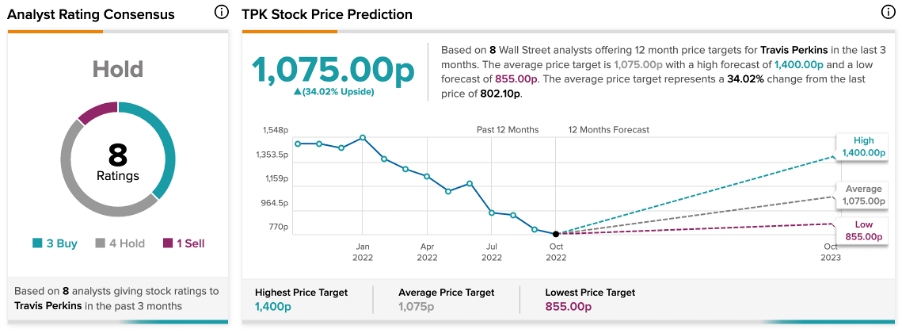

According to TipRanks’ analyst consensus, Travis Perkins has a Hold rating.

The TPK stock forecast is 1,075p, which is 34% up from the current price level. The analyst price targets range from a low of 855p per share to a high of 1,400p per share.

Conclusion

Riding on positive numbers, the company expects its full-year operating profits to be in the range of £304 – £340 million.

The company is expecting some challenges based on macroeconomic uncertainty, but it remains focused on its cost management and a flexible operating structure to adapt more smoothly.