There are positive signs emerging once again for travel, now that virtually every COVID-19 related restriction, rule, and lockdown has slipped into the dustbin of history, and may it never reemerge. However, the positive signs aren’t universal. Just ask Hyatt Hotels (NYSE:H), who lost over 9% in Thursday afternoon’s trading following its earnings report release.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Hyatt’s earnings didn’t exactly catch investors’ attention. First, Hyatt faltered on EPS figures; it posted $0.82 per share, and analysts were looking for $0.86. That’s not great, and net income didn’t help either. Hyatt posted $68 million in revenue, which is good by itself, but looks awful against the $206 million posted in 2022’s second quarter. Hyatt’s CEO, Mark Hoplamazian, tried to rally, but faltered, noting that Hyatt posted “record results,” and did so for its “fifth consecutive quarter.” The differences, however, were too strong to get past.

Worse, these results come at a time when analysts are coming out in favor specifically for Hyatt Hotels. Conor Cunningham and Daragh Regan with Melius both offered support for Hyatt in particular, noting that consumers were specifically focusing on urban markets when it came to travel. That was a distinct plus for Hyatt, which focuses therein. With a potential return of corporate travel also in the cards—why not? There’s a call to return to the office, too, so why not corporate travel?—that’s another potential win for Hyatt in the books. But given the sheer decline in earnings, it may not be enough.

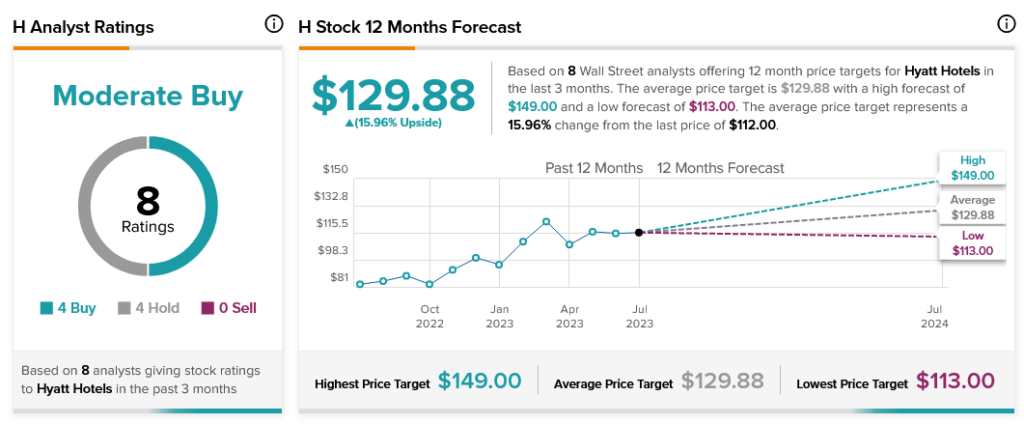

Meanwhile, analysts are perfectly split on Hyatt’s future. With four Buy ratings and four Hold, Hyatt Hotels stock is considered a Moderate Buy. Further, with an average price target of $129.88, Hyatt Hotels stock offers a 15.96% upside potential for investors.