Casino stocks got slammed back in the COVID-19 days, and now they’re making a comeback. When China abandoned the “Zero-COVID” plan in favor of more of a “Let’s Have an Actual Economy” plan, that meant great things for gambling in the region as well. Las Vegas Sands stock (NYSE:LVS), which has a substantial Asian presence, finished higher as tourism in the region is coming back.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s not the first time we’ve heard about the revival of the Macau gaming trade. It’s been an off-and-on affair for months now. But this time, the revival seems to be sticking around. The Marina Bay Sands resort in Singapore saw an all-time record for revenue only recently, reports noted. Las Vegas Sands, in general, managed to turn in a solid quarter, and it’s expecting big things from next quarter as well.

Granted, the macroeconomic picture isn’t looking that great. That’s likely going to depress trade at least somewhat. However, analysts are coming out increasingly in favor. Joseph Greff of J.P. Morgan noted that both Singapore and Macau markets were on the rise. He also increased full-year estimates for the Marina Bay Sands, as well as Macau.

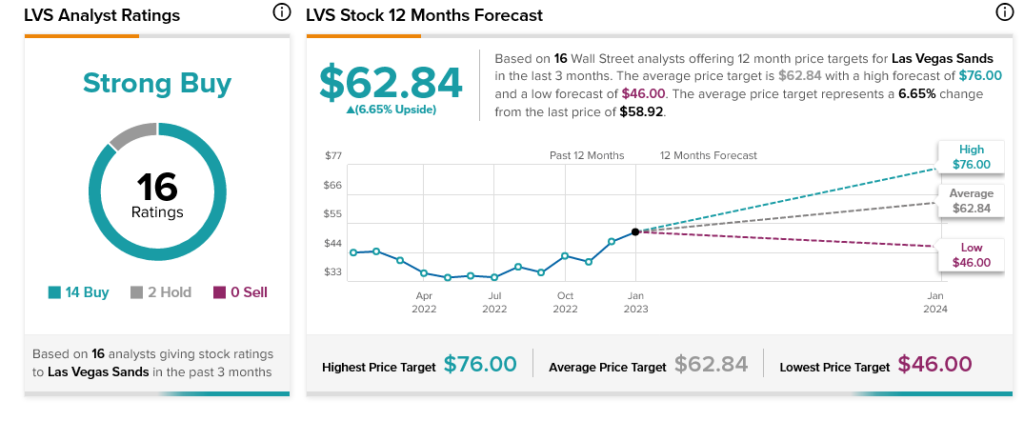

Overall, analyst consensus calls Las Vegas Sands stock a Strong Buy. With an average price target of $62.84, it has 6.65% upside potential.