It’s a safe bet that golf equipment maker Topgolf Callaway Brands (NYSE:MODG) is dying for a mulligan on its earnings projections. Things proved so bad for the manufacturer that its share price was down nearly 15% at the time of writing.

The biggest problem was not Callaway’s earnings report itself. That turned out to be a winning scorecard all around. It posted $0.17 per share in earnings, which beat the consensus of $0.15 per share. Further, it posted $1.17 billion in revenue. That was both a win against the consensus—which called for $1.14 billion—and an upswing from last year of 12.5%. Its same-venue sales growth was up 11% year-over-year, and that represented the sixth quarter in a row that same-venue sales were up.

The problem emerged when Callaway offered guidance. Normally, according to George Kelly of Roth MKM, Topgolf Callaway likes to play its projections close to the vest and offer up a softball projection it’s quite sure it can beat. This time around, it offered up projections between $1.175 billion and $1.195 billion. Great…except analyst consensus was looking for $1.22 billion. While Callaway has set up a slate of initiatives designed to improve revenue, it didn’t offer much detail about what would go into those initiatives.

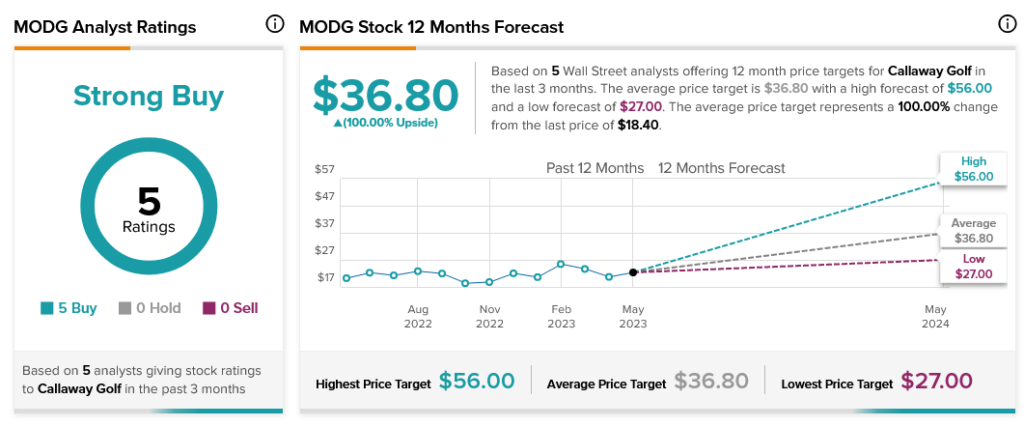

Analysts do expect big things out of Topgolf Callaway, with five analysts offering Buy ratings to make Callaway stock a Strong Buy. Plus, it offers 100% upside potential thanks to its average price target of $36.80.