Top Jefferies analyst Blayne Curtis raised his price targets for Nvidia (NVDA) and Broadcom (AVGO) stocks to reflect optimism about their recently announced deals with hyperscalers. Moreover, Curtis assigned AVGO Top Pick status and called the stock a Franchise Pick based on its “outsized upside relative to estimates.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The 5-star analyst noted OpenAI’s two separate deals involving the deployment of 10 GW (gigawatts) of capacity with chip giants Nvidia and Broadcom, and a 6 GW partnership with Advanced Micro Devices (AMD). He also noted OpenAI’s $38 billion deal with Amazon’s (AMZN) AWS unit for Nvidia GPUs.

Top Jefferies Analyst Raises NVDA Stock Price Target

Curtis raised his price target for Nvidia stock to $240 from $220 and reiterated a Buy rating. The analyst noted that during the GTC 2025 event, Nvidia revealed $500 billion in orders for 2025 to 2026 across its Blackwell and Rubin chips. Curtis estimates about $464 billion in revenue from these two platforms, implying an upside of $36 billion if Nvidia meets its projection.

Considering Nvidia’s update, the analyst raised his calendar year 2026 and 2027 revenue estimates to $293 billion and about $385 billion, respectively, from $283 billion and $334 billion. Curtis also raised his EPS estimates for 2026 and 2027 to $6.83 and $9.03, respectively, from $6.55 and $7.72.

Curtis continues to view NVDA as the dominant player compared to the rest of the market, with the semiconductor giant offering “all the building blocks, including GPU, CPU, NIC, Scale Up Switch, Scale Out Switch, and now CPX.”

Wall Street has a Strong Buy consensus rating on Nvidia stock based on 37 Buys, one Hold, and one Sell recommendation. The average NVDA stock price target of $237.86 indicates 18% upside potential.

Jefferies Calls Broadcom Stock a Top Pick

Curtis contended that while Nvidia remains the leader in the AI space, he assigned the Top Pick status to Broadcom as he sees larger upside to estimates, backed by AVGO’s deals with Alphabet’s (GOOGL) Google, Meta Platforms (META), and OpenAI for its ASICs (Application-Specific Integrated Circuits). Curtis reiterated a Buy rating on AVGO stock and raised the price target to $480 from $415.

The analyst explained that while Google has been AVGO’s main ASIC customer for a long time, he expects volumes to be more significant in 2026 and 2027. Curtis noted the increase in the number of tokens that Google processes per month. The analyst also highlighted that channel checks indicate a surge in Google’s Tensor Processing Unit (TPU) volumes to about 3 million units in 2026, with possible upside beyond that, driven by the new deal with Anthropic for up to one million TPUs.

Overall, Curtis expects Broadcom’s AI-related revenue to hit $10 billion in calendar year 2027, but added that it “could easily scale to $40-50B per year in C28+ [beyond calendar year 2028].” The analyst increased his revenue estimates for Broadcom for 2026 and 2027 to $100 billion and $130 billion, respectively, from previous estimates of $95 billion and $113 billion. Curtis also raised AVGO’s EPS estimates to $10.31 and $13.88 for 2026 and 2027, respectively, from $9.77 and $11.92. Interestingly, Curtis sees an upside EPS scenario of $20 for 2027 and as high as $30 for 2028 if OpenAI ramps to 2 to 3 GW per year.

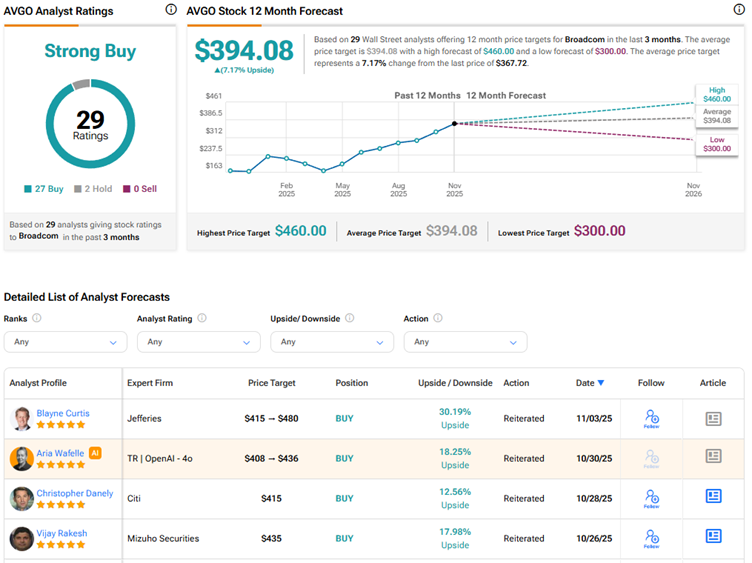

Currently, Wall Street has a Strong Buy consensus rating on Broadcom stock based on 27 Buys and two Hold recommendations. The average AVGO stock price target of $394.08 indicates 7.2% upside potential.