Amazon (AMZN) stock rose 4% on Monday, as investors cheered a $38 billion multi-year deal with OpenAI (PC:OPAIQ). Under this partnership, OpenAI will gain access to “hundreds of thousands” of Nvidia (NVDA) GPUs (graphics processing units) hosted on AWS (Amazon Web Services). Several Wall Street analysts reacted positively to the announcement. In fact, a top Wedbush analyst raised his price target for AMZN stock, indicating further upside potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Amazon stock has risen 12% over the past five trading sessions, bringing the year-to-date increase to 16%. The e-commerce and cloud computing giant recently reported better-than-expected third-quarter earnings, with artificial intelligence (AI) tailwinds driving strong growth in its AWS unit.

Top Analysts Are Optimistic on AMZN Stock

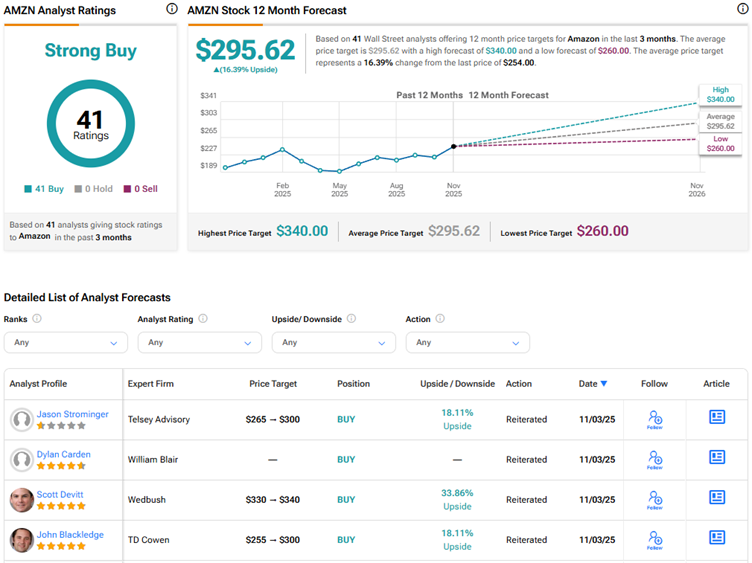

Wedbush analyst Scott Devitt raised his price target for Amazon stock to $340 from $330 and reiterated a Buy rating. The 5-star analyst noted that the planned capacity under the partnership with ChatGPT maker OpenAI is scheduled to come online by the end of next year, with continued expansion over seven years. “Importantly, we believe this deal builds on Amazon’s current partnership with Anthropic, serving as the company’s primary cloud provider,” said Devitt.

Meanwhile, TD Cowen analyst John Blackledge reiterated a Buy rating on AMZN stock with a price target of $300, saying that the partnership with OpenAI “underscores AWS’s scaling AI infrastructure offering.” The 5-star analyst highlighted that the deal follows AMZN’s Q3 earnings call, during which the company mentioned several unannounced October deals, which had surpassed the overall Q3 deal volume. In fact, AWS backlog stood at $200 billion at the end of Q3 2025, without the OpenAI deal.

Blackledge noted that the 20% surge in AWS revenue in Q3 2025 was fueled by growth in core and AI workloads. He expects AWS revenue to increase by 21.4% year-over-year in Q4 and 22.9% in 2026, indicating continued acceleration.

Additionally, Bank of America analyst Justin Post reiterated a Buy rating on Amazon stock with a price target of $303. Post stated that the OpenAI deal is “an important validation for AWS on two fronts.” First, the deal supports the belief that expansion in AWS capacity will accelerate revenue growth of the cloud unit. Second, the dual AI chip approach (using in-house Trainium2 chips for Anthropic and Nvidia GPUs for OpenAI) enables AWS to serve varied client needs. The 5-star analyst highlighted Amazon’s strength in addressing diverse customer requirements, as reflected in its partnerships with OpenAI and Anthropic, with the two AI companies now using a mix of first-party and third-party chips on AWS.

Is Amazon Stock a Buy, Hold, or Sell?

With 41 unanimous Buys, Amazon scores Wall Street’s Strong Buy consensus rating. The average AMZN stock price target of $295.62 indicates 16.4% upside potential from current levels.