Advanced Micro Devices (AMD) stock popped 24% on Monday, as investors cheered its lucrative deal with OpenAI (PC:OPAIQ), under which the ChatGPT maker will deploy up to 6 gigawatts of AMD’s graphics processing units (GPUs) over multiple years. AMD stock was up 4% in Tuesday’s pre-market trading. Wall Street cheered the partnership, with many top analysts raising their price targets to reflect optimism about AMD’s growth prospects.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, under the deal, AMD has issued OpenAI a warrant for up to 160 million shares, structured to vest as specific milestones are achieved.

Top Baird Analyst Boosts AMD Stock Price Target on OpenAI Deal

Baird analyst Tristan Gerra increased the price target for AMD stock to $240 from $175 and reiterated a Buy rating. The 5-star analyst believes that OpenAI’s use of AMD’s MI450 validates what he has heard from his industry discussions about the competitiveness of these chips. He added that OpenAI’s deal could help AMD reach — or even surpass — a 20% market share with its MI450 chips.

Checks by Gerra’s firm indicate that MI450 will enable AMD to gain AI GPU share at other customers in 2027, with two hyperscalers considering these chips in addition to one being committed. Gerra noted that each gigawatt of compute deployed under the OpenAI deal is expected to generate “significant incremental double-digit billions of dollars” for AMD. He highlighted management’s optimism about this partnership driving additional revenue from new and existing customers, with the potential to generate well over $100 billion in revenue over the next few years.

Stifel and Roth Capital Analysts Weigh in on AMD’s OpenAI Deal

Stifel analyst Ruben Roy increased his price target for AMD stock to $240 from $190 and reaffirmed a Buy rating. The top-rated analyst believes that the deal with OpenAI positions AMD as a co-design partner in the ChatGPT maker’s infrastructure roadmap.

Roy added that the partnership elevates the chip company’s “perceived positioning” in AI compute and rack-scale systems, with management hinting that more such deals are in the works. He added that the structure of the AMD-OpenAI deal is investor-friendly, as warrants only vest when hardware is delivered and AMD’s valuation rises.

Additionally, Roth Capital analyst Suji DeSilva increased his price target for Advanced Micro Devices stock to $250 from $200, while maintaining a Buy rating. The 5-star analyst stated that AMD’s signing of OpenAI as its “flagship customer” establishes it as a credible source of large-scale AI infrastructure provider, competing with its primary rival, Nvidia (NVDA). DeSilva is “encouraged” that OpenAI will make use of newer AMD rack-based solutions. Notably, OpenAI will target both inference and training workloads using AMD’s chips and potentially build an equity stake via milestone-based warrant tranches, noted DeSilva.

Is AMD Stock a Buy or Sell?

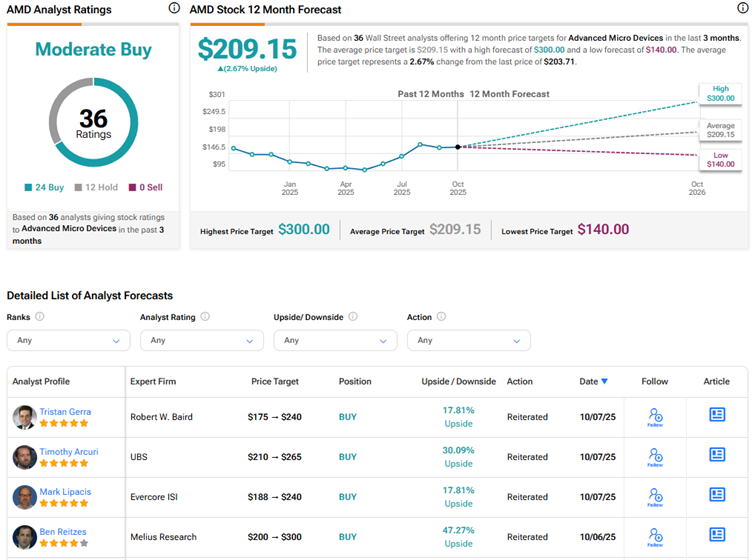

Currently, Wall Street has a Moderate Buy consensus rating on Advanced Micro Devices stock based on 24 Buys and 12 Holds. The average AMD stock price target of $209.15 indicates 2.7% upside potential from current levels. AMD stock has rallied 69% year-to-date.