It’s all gone pear-shaped for Nio (NYSE:NIO), and investors have been turning away in droves. Sentiment has really soured around the Chinese EV maker as the company has been affected by weakening domestic demand in an environment defined by fierce competition, with Nio seen to be lacking meaningful near-term catalysts that can reshape the story.

Most recently, the narrative hasn’t been helped by the company reducing its expected Q1 delivery haul from the range between 31,000 to 33,000 vehicles to around 30,000. While the stock got a little bounce following the actual release of the quarter’s numbers (Nio delivered 30,053 vehicles during Q1, amounting to a 3% year-over-year decline and a 40% sequential drop), the overall trend has been down, as evident in the share price’s year-to-date loss of 50%.

But as any savvy investor knows, when everyone is running scared is often the best time to be loading up. The question, of course, is whether Nio is worth taking a chance on right now. According to financial researcher and investor On the Pulse, the answer is a definite yes. In fact, the investor thinks that with the shares now trading below $5, the stock is “a steal.”

While no doubt operating in a difficult climate and faced with numerous challenges, OTP believes the EV maker “unduly suffers from a painful change in sentiment towards EV businesses.” The researcher also thinks Nio stands to gain from a “rebound in deliveries” later this year, noting that Q1 doesn’t paint a true picture of demand given it includes the 15-day Chinese New Year period. For example, says OTP, between 1Q23 and 4Q23, NIO’s deliveries grew by a meaningful 61%. Furthermore, fundamentals are improving with 4Q23 gross profit reaching RMB 1,279.2 million (US$180.2 million), more than doubling vs. the figures seen a year ago.

As such, with the shares on the backfoot, OTP thinks the valuation is “now at its most compelling point ever,” making the present the best time to buy NIO shares. “The long-term outlook for the electric-vehicle industry is positive and investors should anticipate ups and downs in both NIO’s underlying business as well as in the stock price,” OTP says. “I continue to anticipate a gradual recovery in delivery volumes in the coming quarters and think that NIO presently has its best risk/reward relationship in years.”

To this end, On the Pulse upgraded their rating on the stock from Buy to a Strong Buy. (To watch On the Pulse’s track record, click here)

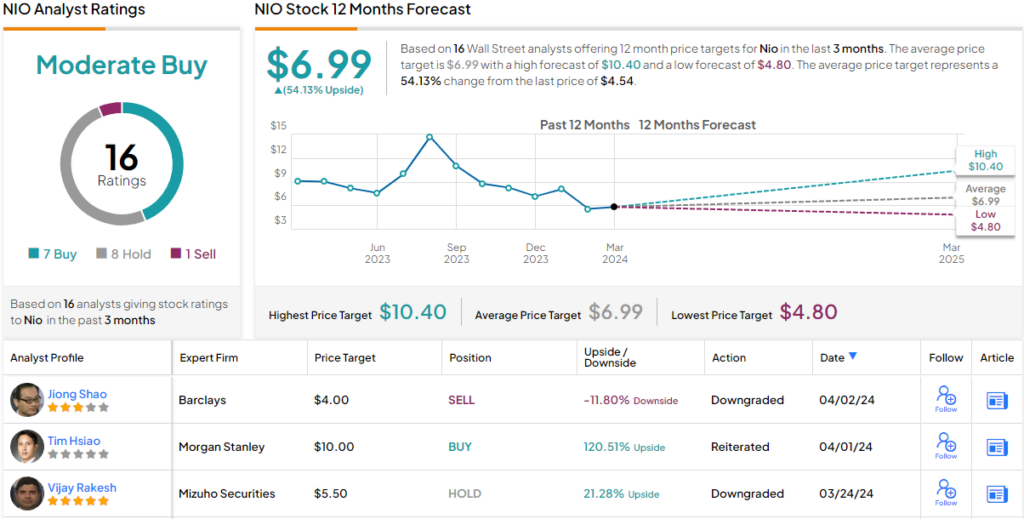

Turning now to the Wall Street view, where the stock claims a Moderate Buy consensus rating, based on a mix of 7 Buy recommendations, 8 Holds and 1 Sell. The average price target stands at $6.99, suggesting the shares will surge 54% over the one-year timeframe. (See Nio stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.