There’s only one true key to making gains in the stock market, and that’s to build a portfolio of return-oriented stocks. For investors, the ‘trick’ is to find those stocks that are primed to bring returns. The Street’s analysts will sometimes post one clear sign to follow: when they upgrade their stance on shares.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

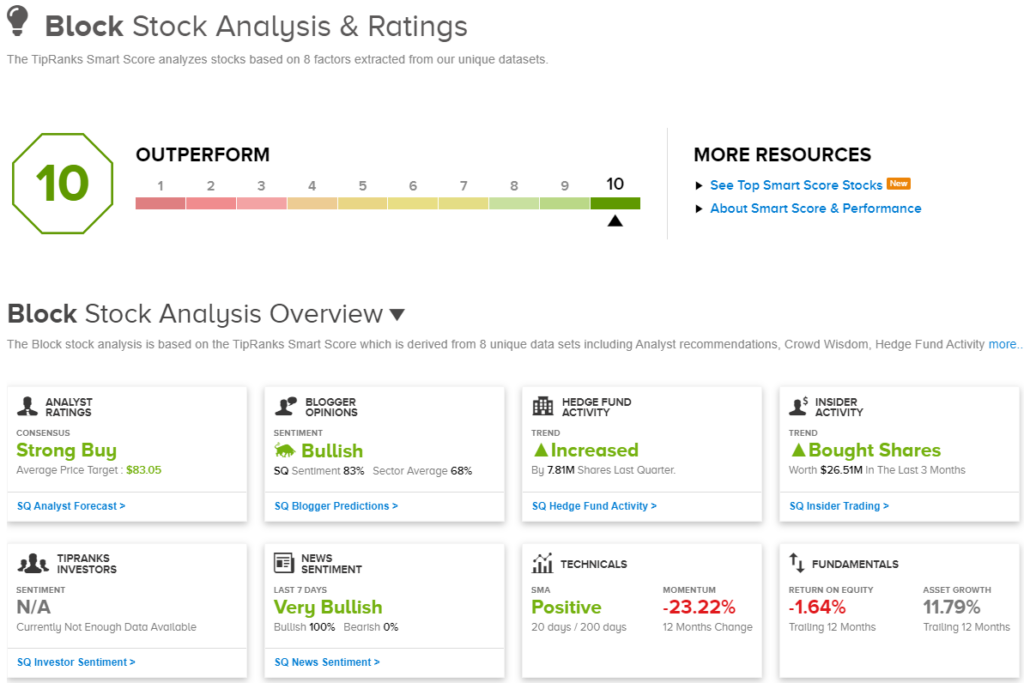

A ratings upgrade on a stock definitely shows a positive shift in sentiment, one that investors can follow for sound returns. There are other signals out there, however, including the Smart Score, a sophisticated data-sorting algorithm developed by TipRanks. It sifts through and collates the reams of data generated by the market’s daily activities.

The Smart Score uses the gathered and sorted data to compare every publicly traded stock to a set of factors that have proven to correlate closely with future out-performance. It distills the results of that comparison into a simple score, on a scale of 1 to 10, with a ‘Perfect 10’ indicating a stock that should get a closer look.

When stock signals come together – for example, when ‘Perfect 10’ stocks also boast a recent analyst rating upgrade – that’s a possible indication that here is a stock that’s ready to jump.

So let’s take a closer look at two stocks that match that profile. Using the TipRanks platform, we’ve found a couple of shares that boast both the ‘Perfect 10’ and a recent upgrade. Here is the lowdown on them, along with comments from the analysts.

Block, Inc. (SQ)

We’ll start in the world of financial technology, fintech, with Block. Block is the holding company that owns the rights to two important names in online commerce, Square and Cash App. These two subsidiaries give Block a hand on both the consumer and merchant sides of the fintech scene, giving the company an important source of business flexibility.

Block’s leading subsidiaries, Square and Cash App, together enable faster business transactions and easy mobile payments. Starting with Square, the app is based on a combination of hardware and software, designed to meet the specialized needs of small businesses and entrepreneurs. Square is famous for its hardware devices, allowing vendors to turn any smartphone or tablet device into a mobile credit card reader or cash register. The app has proven highly popular with kiosk-based small vendors, who get the convenience of putting their back office in their back pocket.

Cash App, Block’s other main product, works from the consumer end. The app makes online payments quick, easy, and universally accessible to users. The app allows users to switch funds from checking to savings, to find credit and debit functions, and even to shift available funds into stock investments.

Taken together, Block’s leading apps smooth out the rough edges of the business world, making it easier for sellers to streamline their transactions and for consumers to make their own money more instantly available and readily accessible.

We’ll see later this month, when Block announces its 4Q23 and full-year 2023 results, just how strong these apps are – but for now, we can look back at the 3Q23 results for a snapshot of the company.

Block reported $5.6 billion in total quarterly revenue, beating the forecast by $190 million and growing 24% from the prior year. While revenue was solid, Block’s bottom line came to a net loss of 5 cents per share – but we should note that this figure beat expectations by 6 cents per share. In an important metric for a fintech, Block reported transaction-based revenue of $1.66 billion in Q3, up 9% year-over-year, and reported Cash App revenue of $3.58 billion, or almost 64% of the total.

This stock has caught the eye of 5-star analyst Moshe Katri, from Wedbush, who describes Block’s foundation in the fintech niche, writing, “We now have increased conviction in the company’s ability to post improving performance in its weak merchant segment (47.7 % of Q3/CY24’s gross profits). In addition to management’s important (positive) decision last quarter to run the company with strict financial discipline and focus on GAAP earnings, we believe accelerating growth in the merchant segment is another important catalyst for the stock’s performance… We may be early on this call (re. improving merchant segment performance), but we believe this change in the pricing narrative will be an important catalyst.”

Katri goes on to set out the reasons for investors to buy this stock including: “1. Management’s disciplined approach to investments and focus on internal efficiencies, including headcount reductions; 2. Likely reduction in the company’s stock based compensation; and 3. The likely termination of unprofitable businesses/initiatives. Finally, per our sensitivity analysis, a 100BPTS improvement in Merchant’s revenue growth yields $0.05 in incremental CEPS, or roughly a 1.7% increase to CY24’s levels.”

To this end, Katri upgraded SQ from Neutral to Outperform (i.e. Buy), while boosting his price target from $70 to $90, indicating his confidence in ~37% upside over the next 12 months. (To watch Katri’s track record, click here)

Overall, Block’s shares have a Strong Buy consensus rating from the Wall Street analysts; 20 reviews, including 19 Buys and 1 Hold, support that view. The shares are trading for $65.85 and their average target price of $83.05 suggests an upside potential of 26% in the year ahead. (See Block stock analysis)

Smartsheet, Inc. (SMAR)

The second stock on our list is another tech firm, Smartsheet, a software company offering office collaboration and work management packages on the popular software-as-a-service subscription model. The company, based in the Pacific Northwest near Seattle, is the developer of its eponymous Smartsheet application and has a history of solid successes in fundraising. It went public in 2018.

Smartsheet has found wide acceptance in the business world, and as of October 31 last year, the app was used by 80% of the Fortune 500 companies. The company’s customer base includes major names such as GM, HP, CVS, and Philips. Smartsheet has received industry recognition as a leader in the work collaboration software segment.

While Smartsheet is a sector leader, the stock has been falling in recent years. Shares of SMAR are down 6% over the past 12 months and more than 39% in the last 36 months. We should note that, while the company is profitable, it missed expectations on earnings last summer.

The most recent earnings report, from fiscal 3Q24 released in December, showed better results. Revenue came to $245.9 million for the quarter, up 23% year-over-year and $4.6 million over the forecast. Smartsheet’s bottom line was 16 cents per diluted share, by non-GAAP measures, a result that was 7 cents per share better than expected. Free cash flow for the quarter came to $11.4 million, and the company had $568.7 million in cash and cash equivalents. Looking ahead, in March, Smartsheet will report its fiscal 4Q24 results, and the Street is expecting to see $255.66 million at the top line.

In his review of SMAR shares, Citi analyst Steve Enders is impressed by the company’s profitability, and it solid product line. He writes of the stock, “We see SMAR’s ramping profitability as driving a shift in the valuation paradigm towards EV/FCF while new product led growth and AI functionality should ease the adoption curve for net new enterprise use cases through CY24 that could drive stability in >$50K and >$100K customer growth. We see cons numbers being achievable for F4Q24 and into FY25 that should drive upside while SMAR trades at a discount to SaaS peers (val regression suggests 8x multiple vs. 5x today) despite line of sight to a sustained Rule of 40 and potential for M&A.”

These comments support Enders’ upgrade on the stock, from Neutral to Buy. He has set his price target at $63, implying a one-year upside potential of ~41%. (To watch Enders’ track record, click here)

All in all, there are 14 recent analyst reviews on file for SMAR shares, with a 13 to 1 split favoring Buy over Hold for a Strong Buy consensus rating. SMAR is currently trading for $44.79 and its $56.17 average price target suggests a gain of 25% by the end of this year. (See Smartsheet stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.