After hitting a new 52-week high of $1,196.50 yesterday, Netflix (NFLX) has been downgraded to Hold from Buy by JPMorgan (JPM) analyst Doug Anmuth. Despite the rating cut, the five-star analyst raised his price target to $1,220 (2.4% upside) from $1,150, citing NFLX’s strong fundamentals but noting that the stock’s risk/reward outlook is less attractive following its recent surge.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Importantly, NFLX stock has gained 34% year-to-date. Also, it has rallied 85.9% over the past year and 549.4% in the last three years.

What Led to the Downgrade?

Anmuth has pointed out three key reasons for the downgrade. Firstly, he noted that Netflix stock is trading at 39 times JPMorgan’s estimate for 2026 GAAP EPS and 44 times its projected free cash flow for 2026. According to JPM, the current stock price likely already priced in potential upside to NFLX’s 2025 outlook.

Secondly, Netflix has been a defensive play amid tariff and macro uncertainty. However, if conditions improve, Anmuth believes investors may shift funds into other internet stocks that have been under pressure.

Finally, the analyst cited typical summer viewership softness and a less prominent catalyst pipeline as another reason for lowered rating.

Analyst Highlights Netflix’s Strong Fundamentals

Despite the downgrade, Anmuth noted that Netflix’s strong fundamentals. He projects double-digit revenue growth (excluding currency fluctuations) through 2026, margin expansion, increasing free cash flow, and greater share repurchases.

Further, the Top analyst said that the company’s ad-supported tier is also gaining traction, with NFLX anticipating its ad revenues to double in 2025.

Is NFLX a Buy, Hold, or Sell?

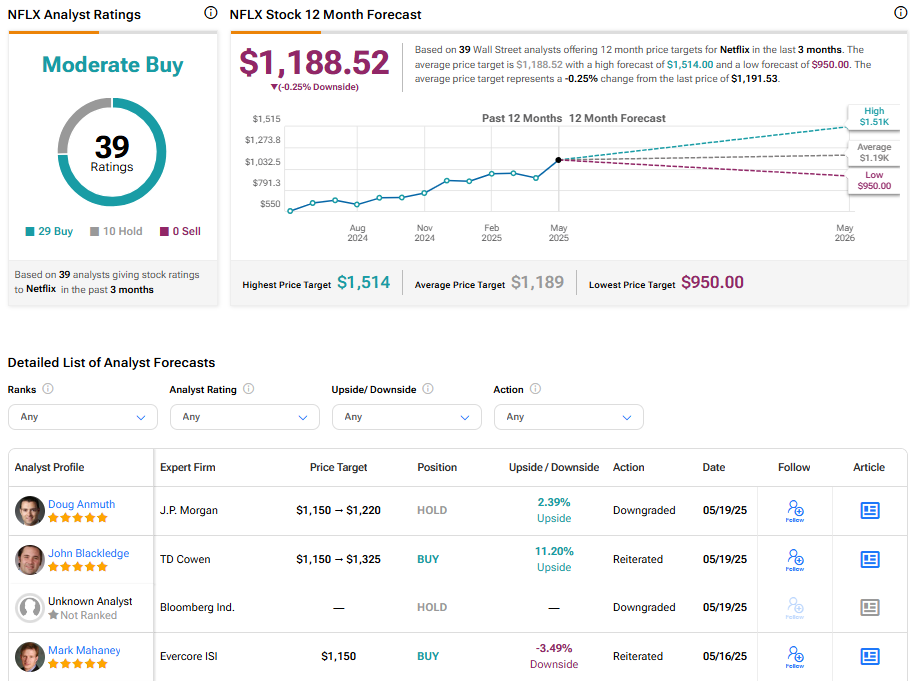

Turning to Wall Street, NFLX stock has a Moderate Buy consensus rating based on 29 Buys and 10 Holds assigned in the last three months. At $1,188.52, the average Netflix stock price target implies a 0.25% downside potential.