Intel’s (NASDAQ:INTC) restructuring of its financial reporting framework is now done and the Street did not like the initial look of some of the numbers on display. Hence, the shares were taking a beating in Wednesday’s trading session.

From now on, Intel will disclose results across seven distinct segments: 1) Client Computing Group (CCG); 2) Data Center and AI (DCAI); 3) Network and Edge (NEX); 4) Intel Foundry; 5) Altera; 6) Mobileye; and 7) Other. The primary business units, CCG, DCAI, and NEX, are part of Intel Products, primarily focusing on the design and advancement of computing products and associated tech. Intel Foundry, a newly introduced division, will encompass the development of foundry technology, manufacturing, supply chain, and related services.

As anticipated, most of the Street’s focus immediately turned to the foundry business, which according to the disclosures, incurred a $7 billion loss in 2023, expanding from the $5.2 billion loss recorded in 2022. Revenue from this segment also saw a significant decline, falling by 37% in 2023 to $18.9 billion, given softness seen across various product categories.

Intel anticipates that the operating losses of the foundry segment will reach a peak in 2024 and subsequently drop over the following years. The company is aiming for the segment to break-even around 2027. By the end of 2030, Intel is eyeing non-GAAP gross margins of 40% and operating margins of 30%. By then the company has set its sights on becoming the world’s second-biggest foundry.

As the company navigates this transition, is it now time to turn bullish on the semiconductor giant? Not according to Stifel’s Ruben Roy, who ranks amongst the top 3% of Wall Street professionals. Roy thinks the company is heading in the right direction, but there are other chipmakers that remain more appealing.

“While we continue to view INTC’s incremental steps towards the IDM 2.0 vision positively, with a multi-year execution cycle still ahead, we continue to prefer nearer-term AI beneficiaries, NVDA and AMD,” the 5-star analyst said.

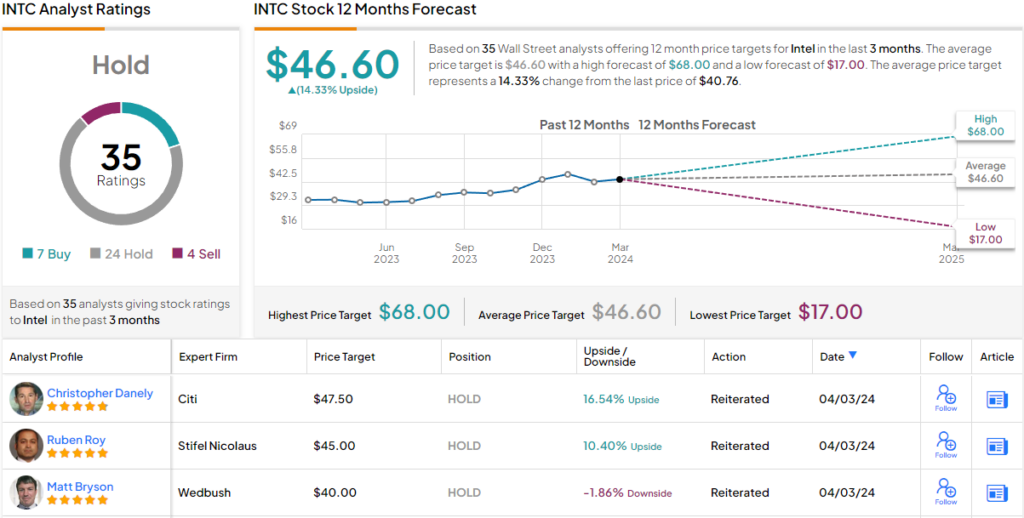

Accordingly, Roy rates INTC a Hold (i.e., Neutral) along with a $45 price target, implying shares will climb 8% higher from current levels. (To watch Roy’s track record, click here)

Most of Roy’s colleagues also stay on the sidelines for now. Based on a mix of 24 Holds, 7 Buys and 4 Sells, the analyst consensus rates the stock a Hold. Going by the $46.60 average price target, the shares will appreciate ~14% over the coming year. (See Intel stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.