There’s no doubt that Tilray (TSE:TLRY) got its start as a cannabis stock. While weed is still very much a part of Tilray’s offerings, it’s also been rapidly making inroads into the beverage field as well. In fact, it underscored that point well by acquiring Truss Beverage in a recent deal with Molson Coors (NYSE:TAP). The move didn’t do much to endear investors to Tilray, however, as shares dropped nearly 2% in Wednesday afternoon’s trading.

The deal has been in the works since last August, reports note, when Tilray first announced its plans to take over the Truss brand. With Truss now in Tilray’s control, Tilray gets access to a range of brands from Little Victory to House of Terpenes and several others. This will give Tilray roughly 40% of the entire cannabis beverage market.

A Big Move in the Making?

While Tilray was a force to be reckoned with pre-pandemic, it’s since slumped substantially. However, there are signs of life still brewing under the surface, and some are taking advantage of that. After all, just a little over a third of Tilray’s revenue comes from cannabis, which means it’s pulling in no shortage of cash from beverages and the like. So for Tilray to augment its holdings in beverages just makes sense. Plus, with the very real potential of a reclassification of marijuana still afoot in the U.S., the odds that Tilray could see the floodgates of a very large market open up is still within the realm of possibility.

What is the Target Price for Tilray?

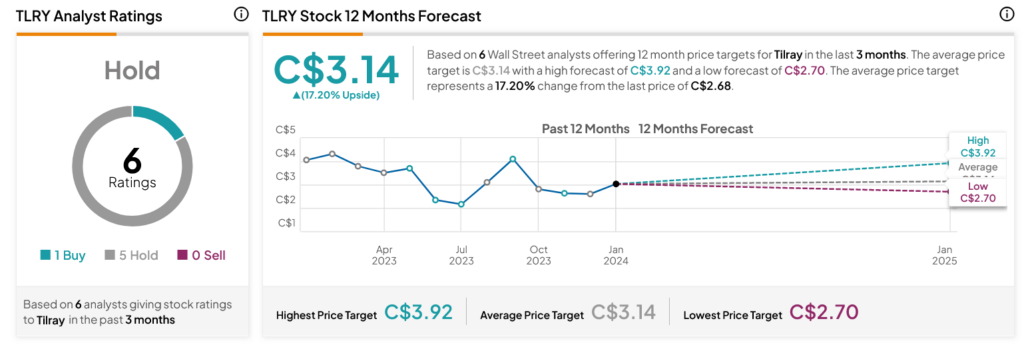

Turning to Wall Street, analysts have a Hold consensus rating on TLRY stock based on one Buy and five Holds assigned in the past three months, as indicated by the graphic below. After a 35.27% loss in its share price over the past year, the average TLRY price target of C$3.14 per share implies 17.2% upside potential.