Tiffany & Co. shareholders have overwhelmingly voted to approve the merger agreement with LVMH, putting an end to the saga between the two luxury goods giants over the impact of the coronavirus pandemic.

At the special meeting held on Dec. 30, more than 99% of Tiffany (TIF) stockholders voted in favor of the $15.8 billion deal. The transaction is expected to close on January 7th of 2021.

The deal was saved after French luxury goods giant LVMH on October 29 this year agreed to acquire Tiffany at a lower price. Louis Vuitton owner LVMH consented to buy Tiffany for a purchase price of $131.50 per share, down from the $135 proposed originally. The revised price takes the total transaction value to about $15.8 billion. Other key terms of the merger agreement remained intact. Tiffany and LVMH had also agreed to settle their pending litigation in the Delaware Chancery Court.

The proposed deal, which was first announced in November 2019, had turned sour when LVMH announced that it could not proceed with the takeover due to Tiffany’s weakening business and the French government’s request to postpone the acquisition until Jan. 6, 2021 to assess the impact of potential US tariffs on French goods. Tiffany then filed a lawsuit against the Louis Vuitton owner in a court in Delaware to enforce the merger agreement.

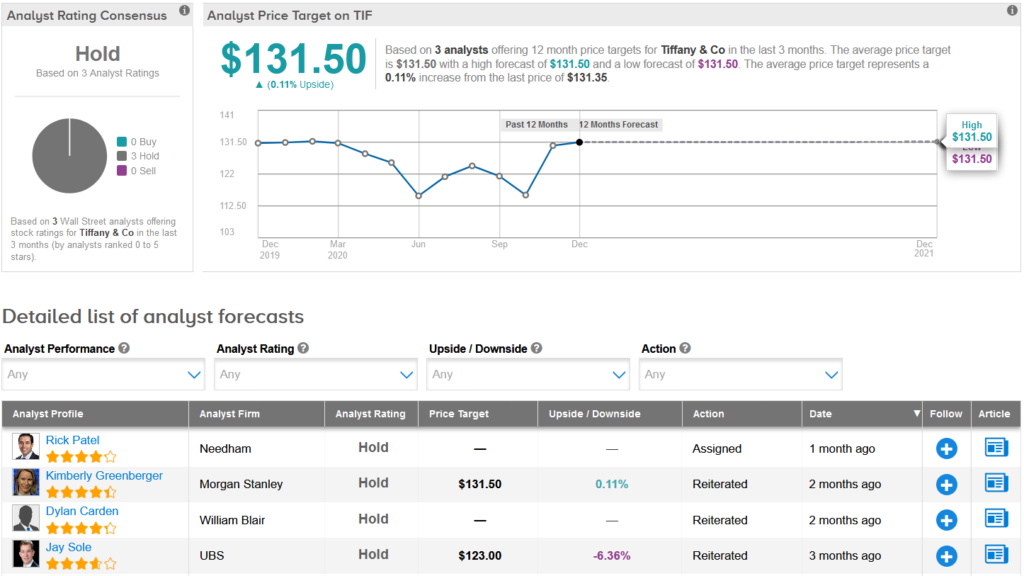

Shares in Tiffany have gained more than 13% over the past three months, trimming this year’s decline to a mere 1.7%. Looking ahead, the average analyst price target stands at $131.50 and indicates that shares are fully priced at current levels.

Needham analyst Rick Patel last month reiterated a Hold on the stock, saying that the rating “reflects low visibility as LMVH is striving to walk away from its deal to buy TIF citing complications related to French foreign affairs.”

The rest of the Street firmly shares Patel’s stock outlook with a Hold analyst consensus backed by 3 unanimous Hold ratings. (See TIF stock analysis on TipRanks)

Related News:

Exxon Set To Make Up To $20B Writedown In 4Q; Merrill Sees 78% Upside

Devon, WPX Shareholders Approve Merger; Shares Climb

Amazon Buys Podcast Startup Wondery; Street Sees 16% Upside