LVMH Moët Hennessy Louis Vuitton, or LVMH (FR:MC) (LVMUY), the luxury giant behind Tiffany, is heading into its Q3 sales report amid cost pressures. As gold prices surged past $4,000 an ounce, rising raw material costs began to weigh on the company’s profit margins for its high-end jewelry business. Investors and analysts are now watching closely to see how these higher costs might impact the outlook for the coming quarters.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Apart from Tiffany, LVMH is known for its iconic brands like Dior, Louis Vuitton, Sephora, Fendi, Bulgari, and more. The company is primarily listed on the Euronext Paris exchange but also trades over-the-counter (OTC) in the U.S.

What to Expect from LVMH’s Q3 Revenues?

LVMH will report its Q3 2025 sales figures on Tuesday, October 13. The company is expected to report flat third-quarter sales when it reports on Tuesday, with a 4% decline in fashion and leather goods and 1% growth in watches and jewelry, according to a VisibleAlpha consensus figure cited by HSBC.

Notably, watches and jewelry account for more than 12% of LVMH’s sales, while fashion and leather goods represent roughly half of the company’s total revenue. Meanwhile, Tiffany and Bulgari remain among LVMH’s top five brands for annual earnings, according to HSBC estimates.

LVMH’s Jewelry Business Feels the Pinch

The doubling of gold prices over the past two years, along with U.S. tariffs and a weaker dollar, has made it increasingly challenging for Tiffany owner LVMH and other luxury brands to maintain healthy gross margins. Jon Cox, head of Swiss equities at Kepler Cheuvreux, noted that while each factor could be managed individually by high-end jewelry and watchmakers, together they put significant pressure on profits. He added that brands would likely gradually raise prices to help offset the impact.

In contrast, Manuel Lang, equity analyst at Vontobel, pointed out that despite gold’s sharp rally, it accounts for only a small portion of input costs for luxury jewelry brands, which is around 10% of jewelry sales on average.

For context, LVMH’s first-half sales in watches and jewelry were flat, while profits declined 13%.

Is LVMH Stock a Good Buy?

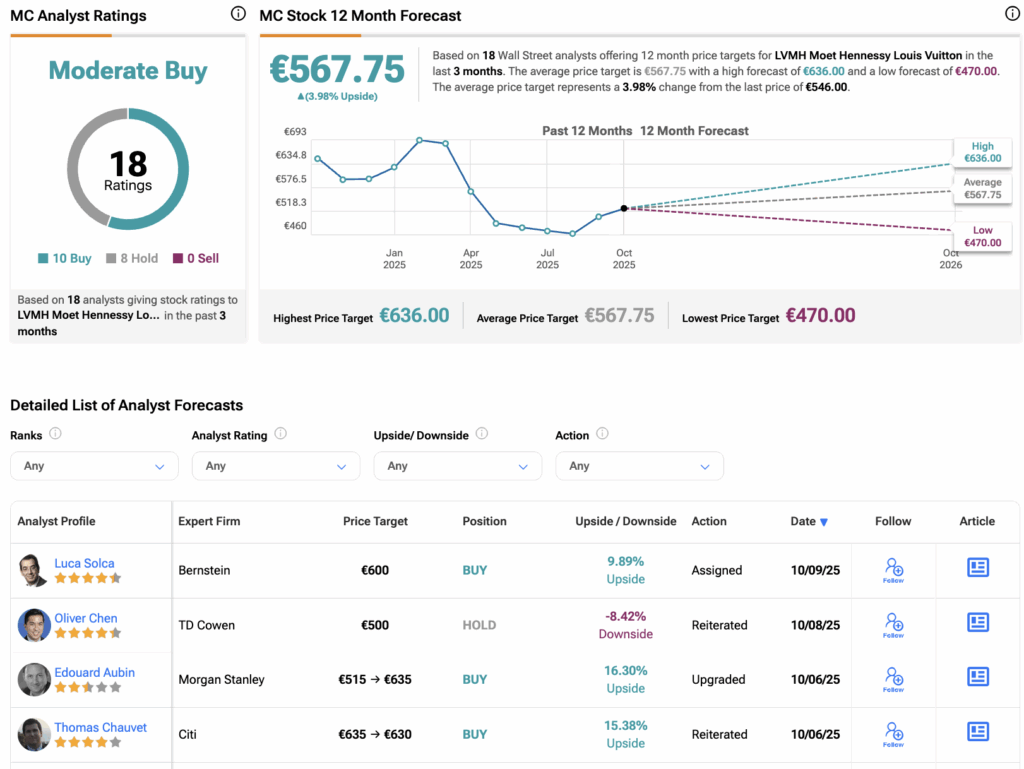

Overall, MC stock has received a Moderate Buy rating on TipRanks, backed by a total of 18 recommendations from analysts. It includes 10 Buys and eight Holds assigned in the last three months. The LVMH share price target is €567.75, which is 4% higher than the current trading level.