One of Enphase Energy’s (NASDAQ:ENPH) Directors, Thurman Rodgers, recently bought the company’s shares worth around $5.5 million. The company manufactures solar micro-inverters, battery energy storage, and EV charging stations primarily for residential customers.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Going by the SEC filing, Rodgers bought 32,900 shares of the company at a weighted average price of $166.88 per share on April 26, 2023. The total value of his holdings now stands at about $200.6 million.

It’s important to note that Rodgers purchased ENPH stock following the company’s better-than-expected first-quarter earnings announcement on April 25. Top insiders’ purchases of stock reflect their optimism for the company’s performance going forward.

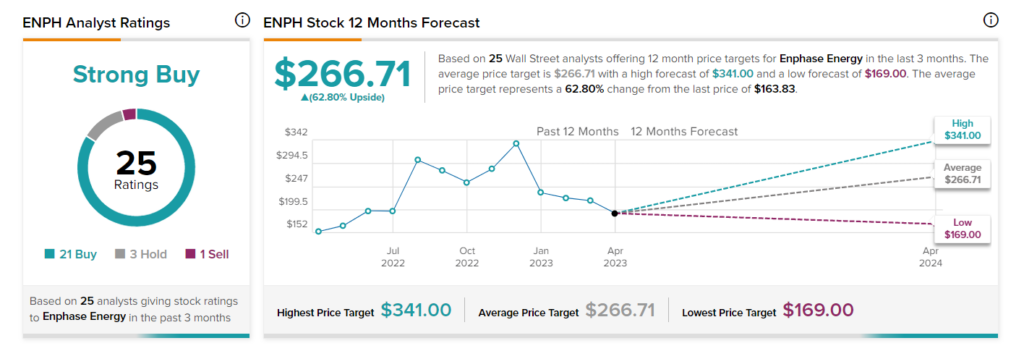

Interestingly, apart from Rodgers’ positive stance, about 12 Wall Street analysts on TipRanks reiterated their Buy rating on Enphase stock yesterday, while two maintained a Hold rating.

Among these, BMO Capital analyst Ameet Thakkar remains bullish on the stock due to the growing IQ8 mix, which is likely to keep supporting margins. He further added, “2023 has challenges in the U.S. but we see plenty of long-term upside from growing European mix and PTCs.”

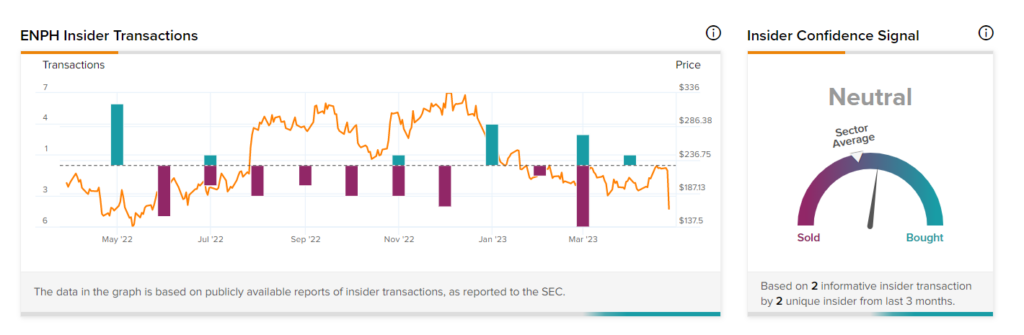

Insider Confidence Signal

Overall, corporate insiders have bought ENPH shares worth $4.5 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in Enphase is currently Neutral.

TipRanks offers daily insider transactions as well as a list of the top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is Enphase a Buy or Sell?

Wall Street is highly optimistic about ENPH stock. It has a Strong Buy consensus rating based on 21 Buy, three Hold, and one Sell recommendations. The stock average price target of $266.71 implies 62.8% upside potential. Shares have tanked by 35.3% so far in 2023.