Enphase Energy (NASDAQ:ENPH) shares fell nearly 17% in Tuesday’s after-hours trading despite reporting better-than-expected first-quarter results. The decline can be attributed to the weaker-than-expected outlook for Q2 provided by the energy technology company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenues came in at $726 million, up 64.6% year-over-year, and also surpassed the analysts’ estimates of $721.8 million. Higher revenues can be attributed to a 25% rise in revenue in Europe.

Meanwhile, the company posted adjusted earnings of $1.37 per share, which came above the Street’s estimate of $1.21 per share. Also, the earnings compared favorably with $0.79 in the year-ago quarter.

In the reported quarter, IQ8 Microinverters, which help convert solar power into usable AC power, accounted for about 65% of Enphase’s microinverter shipments. With plans to enter more nations in 2023, the company recently increased shipments to the Netherlands, France, Austria, and Switzerland.

Regarding guidance, the company has offered a cautious outlook. It expects Q2 revenue between $700 million and $750 million, which is below the analysts’ expectations of $762 million. Moreover, Enphase anticipates an adjusted gross margin in the range of 42% to 45%.

Is ENPH a Good Buy Right Now?

The company’s IQ8 micro-inverters are probably going to sustain its leading position in the inverter market. In addition, Enphase’s prospects appear promising given predictions that its serviceable addressable market will grow to $23 billion by 2025.

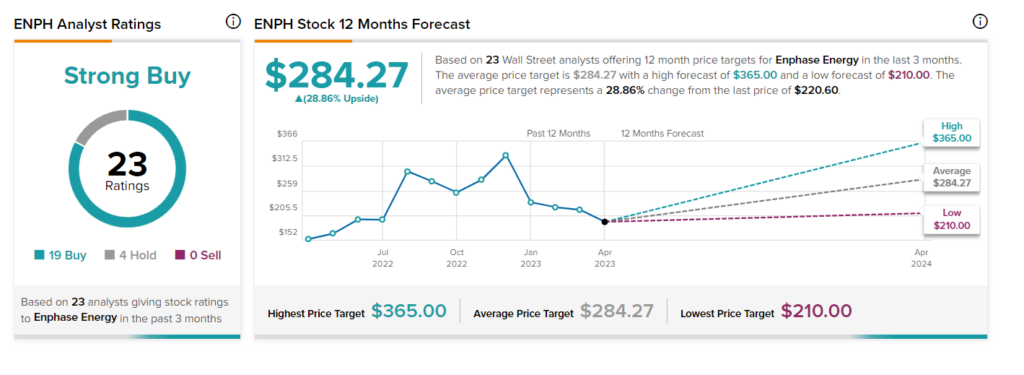

The Wall Street community is optimistic about ENPH stock. It has a Strong Buy consensus rating based on 19 Buy and four Hold recommendations. The stock average price target of $284.27 implies 28.9% upside potential. Shares have tanked 12.9% so far in 2023.