Nvidia (NASDAQ:NVDA) is running away with the artificial intelligence computer chip market. With better than 80% market share in this segment, The Wall Street Journal commented in February that Nvidia’s dominance in AI chips “isn’t yet being challenged in a serious way.”

But it might be soon, if Advanced Micro Devices (NASDAQ:AMD) has anything to say about it.

That’s the big takeaway from Piper Sandler’s Harsh Kumar, a 5-star analyst rated in the top 1% of the Street’s stock pros, as he updates the investment banker’s perspective on AMD and delves into the potential of the Nvidia rival’s acclaimed MI 300 AI chip.

Arguing that MI300’s “price to performance ratio” is both “really strong” and “gaining traction” in a market currently dominated by Nvidia’s H100 processor, Kumar predicts that AMD will sell $4 billion worth of MI300 chips this year, and nearly double that number to $7.6 billion in 2025. What’s more, the analyst seems convinced that AMD will be able to produce all the chips it needs to sell in order to hit these targets.

If he’s right about that, then by the end of next year, AI chips could potentially account for as much as 25% of total sales by AMD. And yet, AI is only a part of this analyst’s buy thesis for AMD, and only part of the reason Kumar believes that AMD stock will fetch $195 a share within a year – and should be bought. (To watch Kumar’s track record, click here)

As Kumar explains, in contrast to the AI market, which it’s only now breaking into, AMD is currently the “incumbent” leader in sales of CPUs for server farms servicing cloud computing companies. Server CPU sales, argues the analyst, will improve year over year in 2024, following the 2023 downturn. Not only does AMD already have momentum in this space. Kumar argues that it will gain market share, too.

At the same time, Kumar is not particularly enthusiastic about the market for graphics chips for gaming – albeit this was once AMD’s bread and butter business. Improvements in gaming chip sales this year will be only “slight” and weighted towards the second half. Moreover, sales declines in the segment will still be “significant” for the year as a whole. Nevertheless, the worst seems to be over, and Kumar sees AMD posting at least “flat” gaming sales in 2025.

Similarly, Kumar thinks that AMD’s embedded chips division – its second smallest by sales – won’t see any kind of recovery for another couple of months. The analyst remains “cautious” on this business. But again, this isn’t AMD’s biggest business and, indeed, it’s likely to be overtaken by AI chips in importance sometime next year. Long term, AI success is going to be deciding factor in whether AMD stock will succeed.

This prediction, however, may not be as optimistic for investors as it sounds. Consider that AMD stock currently sells for a valuation of more than 320 times trailing earnings, and more than 50 times forward earnings. That would be fine if the business was growing 50% a year or better. But in fact, Kumar models only 10% total sales growth this year, and 28% growth next year.

When you consider further that even AMD’s fastest-growing division, which is data centers (AI chips), will grow only 44% next year (according to Kumar), the logic of paying 50x forward earnings for that growth seems questionable – and the logic of paying 320 times trailing earnings even more so.

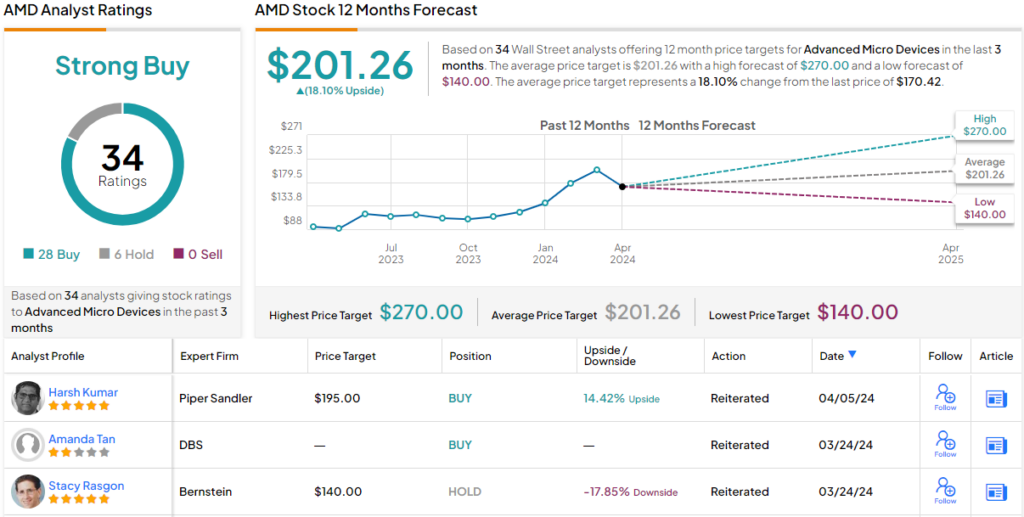

Overall, AMD has most of Wall Street’s analyst corps on its side. Out of 34 recent reviews, 28 recommend to Buy, naturally culminating in a Strong Buy consensus rating. In the year ahead, the shares are anticipated to climb 18%, considering the average price target stands at $201.26. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.