Marc Winterhoff, the interim CEO of EV maker Lucid Motors (LCID), recently shared his thoughts on rival Tesla (TSLA). In an interview with the Financial Times, Winterhoff stated that Lucid is attracting more buyers who previously owned Tesla vehicles, especially when it comes to those who are looking for something newer. More specifically, he said that the Tesla Model S is a key reason why this is happening, as the car now feels outdated. As a result, some customers are switching to the Lucid Air instead.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

And although Winterhoff admitted that Lucid still faces some big challenges going forward, he also pointed to some positive signs, such as Uber’s (UBER) growing interest in the company. In fact, Uber has increased its stake in Lucid and placed an order for 20,000 units of the upcoming Lucid Gravity, which is an SUV that will compete with the Tesla Model X. He also stated that Lucid’s next big step will be to launch a more affordable SUV in the $50,000 range.

Interestingly, Winterhoff also said that the Model S hasn’t changed in 12 years, but that’s not entirely accurate. Indeed, Tesla gave the car a major performance upgrade with the Plaid version in 2021 and refreshed it again in 2024. While the outside looks similar to the original, much of the interior and technology has been updated. That said, sales of the Model S and Model X have dropped over time, and Tesla is now working to make them more appealing by offering a new “Luxe” package to attract buyers.

Which EV Stock Is the Better Buy?

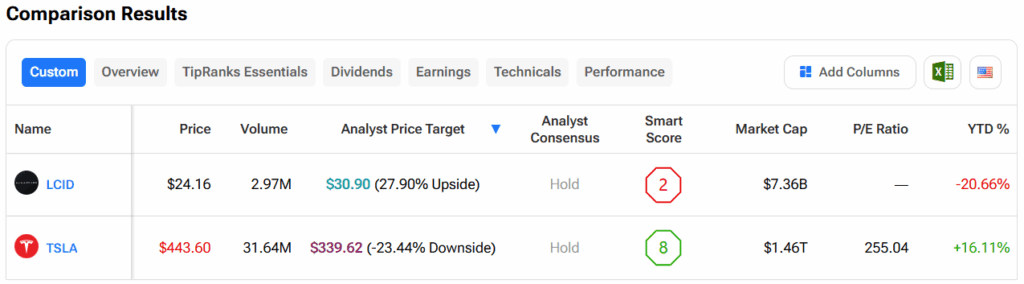

Turning to Wall Street, out of the two stocks mentioned above, analysts think that LCID stock has more room to run than TSLA. In fact, LCID’s price target of $30.90 per share implies almost 28% upside versus TSLA’s 23.4% loss.