One of MoonLake Immunotherapeutics’ (NASDAQ:MLTX) more than 10% owners, Bihua Chen, recently bought the company’s shares worth $16.8 million. The clinical-stage biopharmaceutical company leverages Nanobody technology to develop treatments for diseases, including inflammatory skin and joint diseases.

Going by the SEC filing, Chen bought 827,100 shares of the company at a weighted average price of $20.28 per share in multiple transactions on March 20 and March 21. Following the latest purchase, the total value of MLTX shares in her portfolio now stands at $151.7 million.

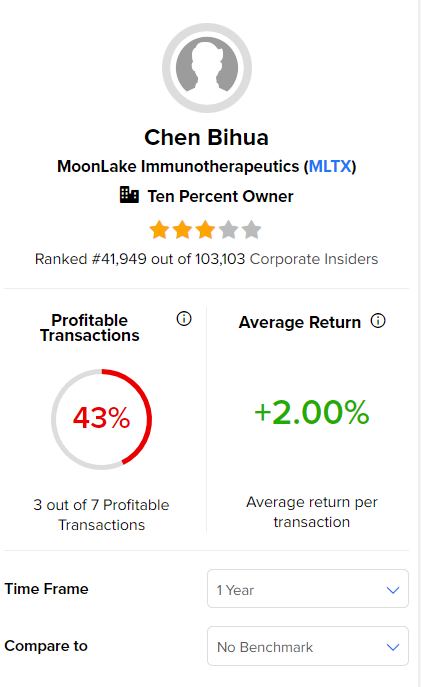

As per the data collected by TipRanks, Chen has had a 43% success rate in her seven transactions over the past year, with an average return of 2% per transaction.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is MLTX a Good Buy?

Yesterday, Wedbush analyst Andreas Argyrides initiated coverage of MLTX stock with a Buy rating and price target of $33. The analyst considers MoonLake as an investment opportunity based on the potential Nanobody technology that can treat inflammatory diseases with high unmet needs.

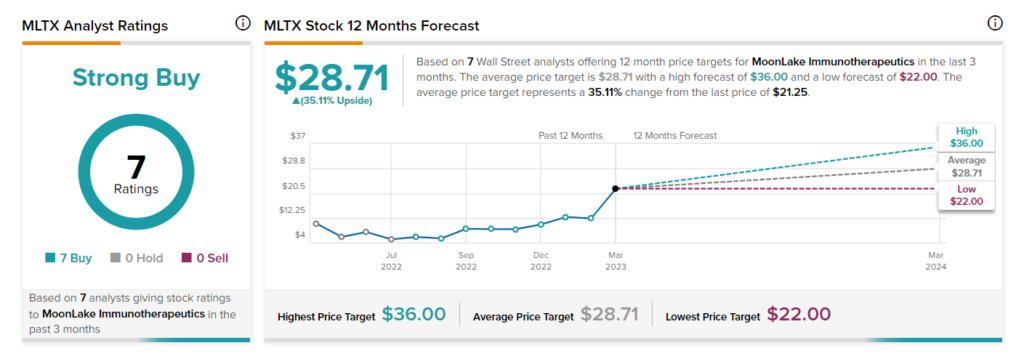

Overall, the Street is optimistic about MoonLake. It has a Strong Buy consensus rating based on seven unanimous Buys. The average price target of $28.71 signals that the stock may surge about 35.1% from current levels. Shares of the company have soared 93% so far in 2023.

Furthermore, MoonLake sports a “Perfect 10” Smart Score, implying it has the potential to beat the broader market averages.