Few things make investors more uneasy than the prospect of share dilution, and SoFi Technologies (NASDAQ:SOFI) experienced this firsthand on Tuesday. Following the announcement of a debt offering, the company saw its share price take a nosedive.

The company disclosed its intention to raise capital through the issuance of convertible senior notes due in 2029. The offering is set at $750 million with an option for an additional $112.5 million, totaling $862.5 million. In parallel, the company disclosed an agreement with holders of its 0% 2026 convertible notes, whereby these notes will be exchanged for $600 million worth of equity. Consequently, the transaction will result in the issuance of approximately 61.7 million new shares, equating to ~6% dilution of existing common equity. However, SoFi has also indicated the potential for further conversion of the 2026 convertible notes.

Based on Wedbush analyst David Chiaverini’s projections, a complete conversion of these notes could potentially lead to approximately 12% of equity dilution.

The prospect of that happening obviously did not sit well with investors, who sent the shares tumbling by 15% in the session. That handed back to market all of February’s gains, which came off the back of a Q4 report that showed SoFi had turned a profit at a faster pace than anticipated.

Chiaverini thinks it marks something of a trend at the company, and one it signaled beforehand was not needed. “SoFi has previously messaged that it didn’t require incremental external equity capital to execute on its business plan, but we’ve noticed a sharp pivot over the last six months in which the company has shifted from deploying capital aggressively to instead executing strategies to provide capital relief/building,” the analyst explained. “Balance sheet growth has slowed meaningfully, loans are being sold/securitized more frequently, and [the] indirect equity offering through the conversion of $600 million of 0% debt for equity to shore up capital levels.”

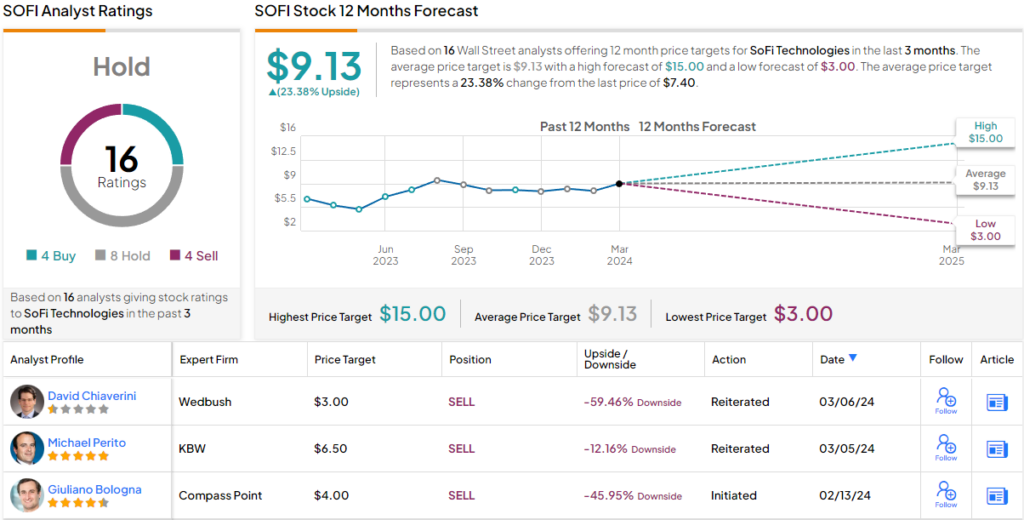

In the expectation of revenue growth slowing and credit costs rising throughout 2024, Chiaverini remains the Street’s biggest SOFI bear. The Wedbush analyst rates the stock an Underperform (i.e., Sell) along with a $3 price target. That figure factors in a sharp drop of 59% from current levels. (To watch Chiaverini’s track record, click here)

All in all, the market’s current view on SOFI is a mixed bag. The stock has a Hold analyst consensus rating based on 8 Hold and 4 Buys and Sells each. However, the $9.13 price target suggests an upside potential of 23% from the current share price. (See SoFi stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.