These are not the best of times for Tesla (NASDAQ:TSLA). That is true both in stock market terms, where the shares have suffered a 34% drop so far this year and in the real world, where the leading EV company has not been able to stave off waning demand and is engaged in price wars with other EV makers vying for consumers’ attention.

Adding to the woes, as highlighted by Deutsche Bank analyst Emmanuel Rosner following an investor visit to Tesla’s Fremont factory, recent events have also thrown a spanner in the works. Although Tesla refrained from providing specific commentary regarding its Q1 performance, the company emphasized encountering unexpected challenges in terms of production volume and costs during the quarter. These stemmed from two shutdowns at its Berlin factory, caused by supply disruptions linked to the Red Sea conflict and a recent arson attack nearby. While Tesla neither confirmed nor denied any issues regarding the ramp-up of the Model 3 Highland in Fremont or Cybertruck/4680 in Austin, Rosner believes they are “ongoing and impacting Q1.” Tesla also attributed the sluggish Cybertruck ramp to its prioritization of quality.

Tesla also acknowledged a slowdown in the EV market, attributing it in part to misconceptions surrounding EVs and Tesla itself. The company aims to tackle these through public education efforts as it plans to increase spending on advertising and marketing to address concerns such as EV “range anxiety” and highlight the affordability of its vehicles.

For 2024, the company stressed it is in an “intermediary lower-growth period,” as the Model 3/Y models reach maturity, and the next-generation vehicles are not expected to launch until late 2025.

Rosner came away concerned about the short-term outlook, but the analyst thinks investors should look further down the line when considering Tesla’s prospects.

“In the near term, we warn that worries over demand, pricing and earnings could further squeeze consensus estimates and put additional pressure on the stock, especially considering the meaningful downside risk we see to next year’s earnings as well,” Rosner explained. “Longer term, however, we continue to believe much of the stock trajectory will remain about the highly anticipated next-gen platform. As Tesla executes on efficiency initiatives in the next-gen platform, the company could deepen its competitive moat and maintain its lead in the electrification space for years to come.”

To this end, Rosner rates Tesla shares a Buy, backed by a $218 price target. This implies the stock has room for 12-month growth of 33%. (To watch Rosner’s track record, click here)

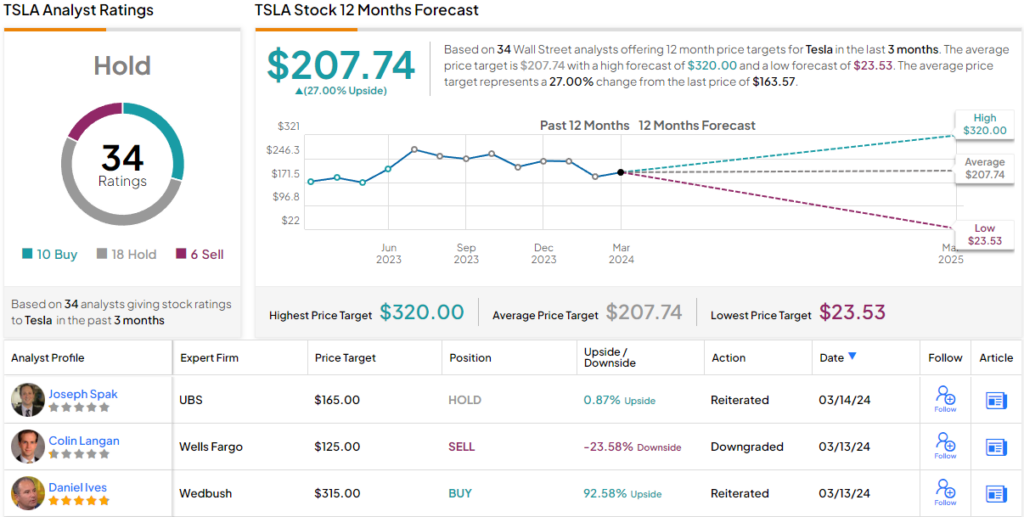

Most on the Street keep a more skeptical stance. Based on a mix of 18 Holds, 10 Buys and 6 Sells, the analyst consensus rates the stock a Hold. That said, there are still nice gains projected; the $207.74 average target factors in one-year returns of 27%. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.