The notion of an AI tech bubble has been brought up intermittently over the past year, given the rally seen in AI-focused stocks. One name that could be included in such a conversation is Palantir (NYSE:PLTR). Seen by some investors as well-positioned to ride the AI trend, the stock has been one of the market’s biggest winners, surging by 198% over the last 12 months.

Yet, 5-star investor PropNotes believes the idea that Palantir might be overvalued in any way is completely redundant. Although when looking at the state of the market, it seems “richly valued at present,” PropNotes does not think that description applies to the big data company, believing there’s still “tons of upside” in PLTR shares.

So, what is driving PropNotes’ bullish take? “Palantir boasts a strong financial profile,” says the 5-star investor. “The company recently turned their first ever profit, and top and bottom-line results continue to grow year-over-year.”

PropNotes also thinks the company seems adept at managing expenses, and that sets a strong foundation for future growth, particularly given the minimal debt and liabilities evident on the balance sheet.

Talking of growth potential, when considering the TAM (total addressable market), Palantir is still in the “early stages” of tapping into various end markets, especially within its commercial segment. Furthermore, last year’s introduction of the Artificial Intelligence Platform (AIP) enriches the product offerings significantly, while PropNotes also argues Palantir’s impressive Net Revenue Retention (exceeding 100%) suggests customers trust the company.

“All in all,” the investor sums up, “while there are some risks associated with purchasing PLTR stock ‘up here’ (in terms of the multiple), we think that PLTR’s significant, B2B AI tailwinds, strong financial footing, and continued opportunities for growth should propel the stock towards $50 per share over time.”

That figure implies ~122% upside potential from current levels. As such, PropNotes rates PLTR shares a ‘Strong Buy.’ (To watch PropNotes’ track record, click here)

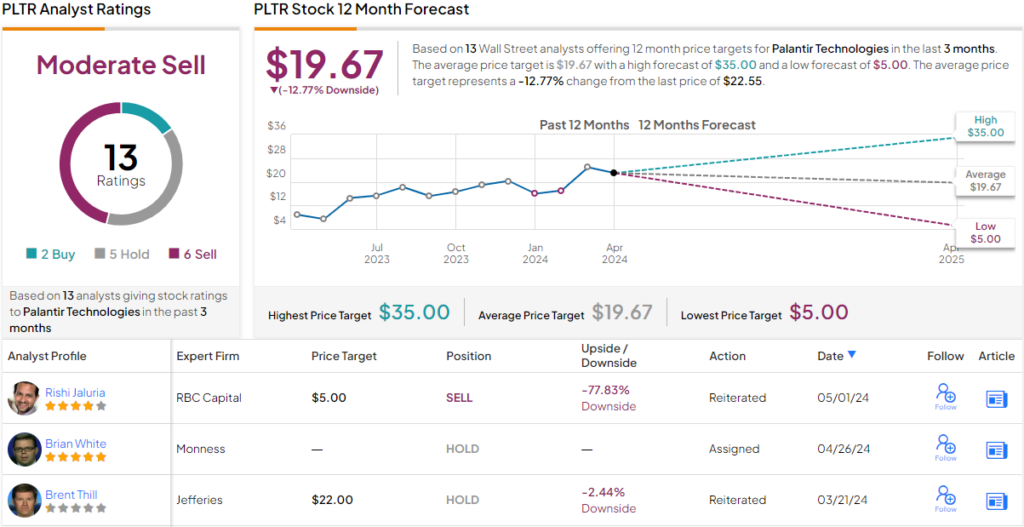

That take, however, stands in stark contrast to the general mood on Wall Street. While 2 analysts take a bullish stance, they are outgunned by 6 Sells and 5 Holds, all coalescing to a Moderate Sell consensus rating. According to the analysts, the shares are expected to decline ~13% in the months ahead, considering the average target stands at $19.67. (See Palantir stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.