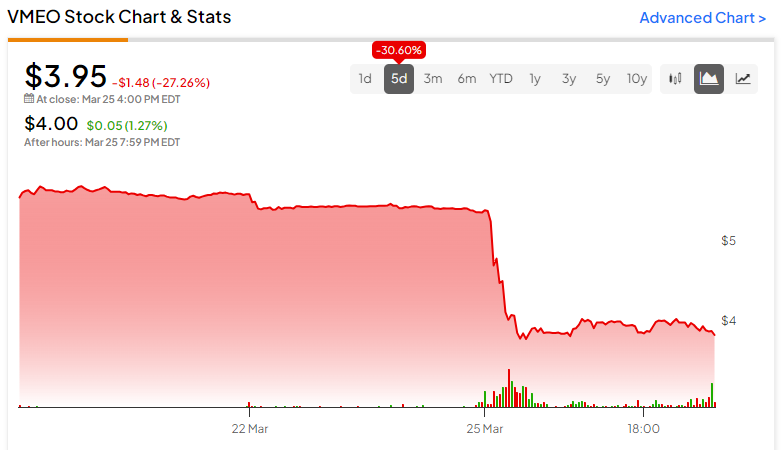

Shares of video software solutions provider Vimeo (NASDAQ:VMEO) were up big over the past month after rumors of a potential acquisition hit the news. On no apparent news, the shares surrendered all those gains in one day, plummeting over 27% on Monday. With the stock now down almost 90% over the past three years and exhibiting wild volatility spikes, prudent investors may want to avoid this one and leave it to the wildcat speculators.

On March 5, Bloomberg reported that Bending Spoons, a leading European mobile app developer and owner of popular apps like Evernote and Meetup, was in deep talks with banks about financing the potential acquisition of Vimeo.

Wherefore Art Thou, Vimeo?

Vimeo Holdings is a comprehensive video software solution provider that leverages the software-as-a-service model to empower users worldwide to create, collaborate, and communicate with video on a singular platform.

The company is undergoing significant changes to ensure its positioning in a highly video-centric future by shifting towards a more product-led growth strategy. The changes have already begun to reflect positively on the company’s internal operations and customer value offerings.

The rumored potential acquisition looked to be a path forward for the company, and shareholders were quick to jump on it. The recent capitulation in the VMEO share price suggests some market participants may have thrown in the towel on the rumor coming to fruition.

Shortfalls and Opportunities for Vimeo

Vimeo’s recent Q4 results exceeded expectations, with EPS of $0.05 beating the estimated consensus of -$0.01 and revenue of $105.5 million outpacing the consensus of $102.31 million. However, total bookings decreased by 3% in the same quarter.

For Q1, Vimeo forecasts revenue of about $100 million, falling slightly short of the estimated consensus of $102.01 million, with an operational loss ranging between $2 million and $4 million. For FY24, Vimeo expects revenue between $385 million and $400 million, below the consensus of $418.72 million. It projects an operating loss of approximately $5 million.

The company finished 2023 with a reasonably strong balance sheet, boasting $300 million in cash and marketable securities, with no long-term debt. There are things to like about VMEO, and this is one of them. It could be an attractive opportunity if the company can slug its way through a soft 2024 and find some upward momentum in earnings.

Is VMEO a Buy, Hold, or Sell?

After the recent slide, VMEO stock is trading toward the lower end of its 52-week price range of $3.01-$5.77. While this has pushed the shares into relative value territory based on several comparative metrics, the fluid nature of the situation suggests holding off on making a final determination on appropriate valuation.

If negative price momentum subsides and no further news is forthcoming, there will be a window to revisit and determine if a value trade makes sense.

Before the most recent volatility spike, analysts were leaning toward caution. The stock is rated a Hold based on one Buy and three Hold ratings in the past three months. The average price target for VMEO is $5.38, representing a 36.20% upside from the last closing price. However, I suspect there will likely be some reversions to price targets, so I would not anchor my expectations on these numbers.

Big Picture

Vimeo shares have been on a rollercoaster ride in a period marked by heightened volatility. Absent any further positive developments with Bending Spoons or other potential suitors, the extreme instability, combined with management’s lackluster outlook for 2024, is enough to warrant sidestepping the current chaos. It would be prudent for investors to continue monitoring the situation for potential changes.