PIF, or Public Investment Fund, Saudi Arabia’s sovereign wealth fund, has ramped up its stake in Sea Ltd. (NYSE:SE) and Electronic Arts (NASDAQ:EA). PIF’s latest 13F filings show that it has holdings in 52 companies and raised its stake in Sea and Electronic Arts by 248% and 55%, respectively, in Q1.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Using TipRanks’ data, let’s check what’s on the horizon for SE and EA stocks.

What’s the Prediction for Sea Stock?

Sea Limited is a consumer internet company providing digital entertainment, online payments, and e-commerce platforms. While the company’s first-quarter financials failed to impress and led to a selloff in its stock price, shares of SE are still up over 39% year-to-date.

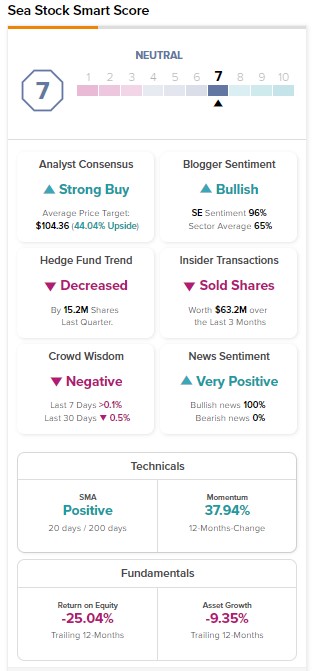

Sea stock has 12 Buy and three Hold recommendations, translating into a Strong Buy consensus rating. At the same time, analysts’ average price target of $104.36 implies 44.04% upside potential from current levels.

While analysts are bullish, Sea stock has witnessed massive selling from insiders and hedge fund managers. Hedge funds sold 15.2M shares of Sea Ltd. in the last quarter. During the same period, insiders sold Sea stock worth $63.2M.

Overall, Sea stock has a Neutral Smart Score of seven on TipRanks.

Is EA a Good Buy Now?

Electronic Arts delivered solid Q4 revenue and net bookings. Further, the company that develops games and content and offers online services expects the momentum in its net booking to sustain in Q1, led by full game sales of Star Wars Jedi: Survivor.

While EA’s business is in a strong position, competitive headwinds and tough year-over-year comparisons keep analysts cautiously optimistic about the stock.

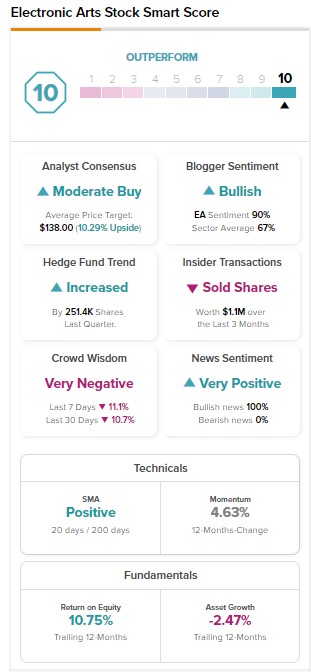

EA stock has received 10 Buy and nine Hold recommendations for a Moderate Buy consensus rating. Meanwhile, analysts’ average price target of $138 implies 10.29% upside potential from current levels.

It’s worth highlighting that insiders sold EA stock worth $1.1M in the last quarter. Nonetheless, it sports a maximum Smart Score of “Perfect 10” on TipRanks.

Bottom Line

Besides for the shares mentioned above, PIF raised its holdings slightly in PayPal (NASDAQ:PYPL) and Air Products and Chemicals (NYSE:APD). Learn more about PIF’s holdings here. At the same time, investors can use TipRanks’ Experts Center tool to look for stocks with a higher potential to outperform the broader market.