Shares of Sea Limited (NYSE:SE) plunged at the time of writing after it reported earnings for its first quarter of Fiscal Year 2023. Earnings per share came in at $0.16, which missed analysts’ consensus estimate of $0.68 per share. Sales increased by 4.8% year-over-year, with revenue hitting $3.04 billion. This was above expectations of $3.035 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue growth appears to have been driven by the firm’s E-commerce and Other Services segment, which increased by 50.7% year-over-year. Indeed, its Digital Entertainment and Sales of Goods segments decreased by 52.5% and 8.7%, respectively. In addition, adjusted EBITDA increased significantly, coming in at $507 million compared to last year’s figure of -$510 million.

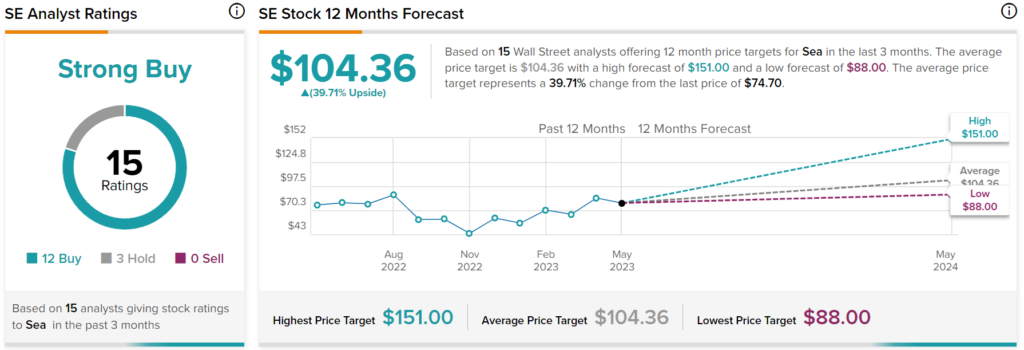

Nevertheless, Wall Street remains positive on SE stock as analysts have a consensus price target of $104.36, implying almost 40% upside potential, as indicated by the graphic above.