With signs appearing all over that the United Auto Workers (UAW) strike may be, at last, coming to a close, we’re starting to see some of the fallout. And Stellantis (NYSE:STLA) made over 3.5% in Tuesday afternoon’s trading thanks to a look at just how much of a hit it took from the strikes. The answer was, interestingly, not as much as Ford (NYSE:F) or General Motors (NYSE:GM).

Stellantis revealed that the strike, which lasted about six weeks and is mostly concluded thanks to reports of a new tentative agreement with the UAW, cost it about $3.2 billion in revenue.Yet, in spite of this massive new crater in Stellantis’ bottom line, Stellantis did not make any sort of adjustment to its full-year 2023 guidance. That’s a step beyond what both Ford and GM did, as both automakers retracted their earlier full-year guidance until they could get a better handle on the impact therein. But Stellantis held the line, including such attractive points as a double-digit margin for operating income, positive cash flows, and wrapping up a $1.6 billion share buyback plan.

In fact, another report from the Detroit Free Press offered another stroke of insight: Stellantis actually reported that its net revenue was up 7% against the third quarter of 2022. That was thanks to several key factors, including better inventories, few issues with the supply chain, and price hikes that were at least partially mitigated by changes in foreign exchange rates. Stellantis also noted that its sales were on the rise all over the world, and a lack of dependence on the U.S market—which is a bit of a problem for Ford and GM—allowed Stellantis to keep running, at least somewhat, throughout.

Is Stellantis a Good Stock to Buy?

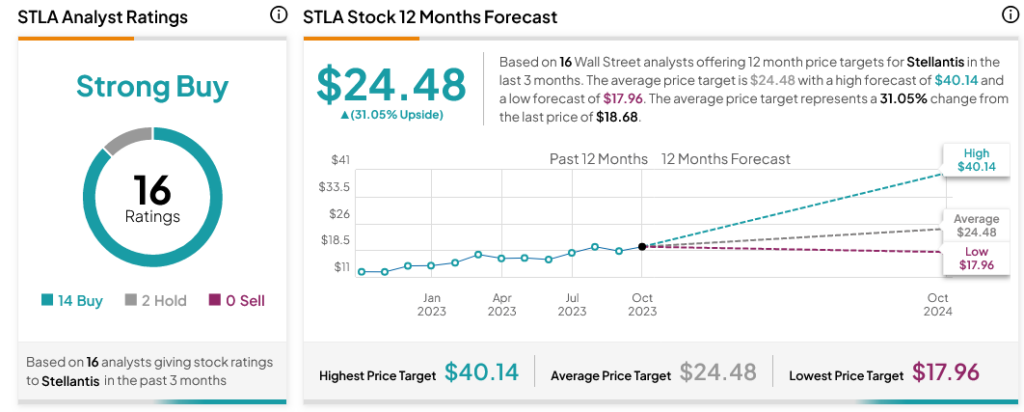

Turning to Wall Street, analysts have a Strong Buy consensus rating on STLA stock based on 14 Buys and two Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average STLA price target of $24.48 per share implies 31.05% upside potential.