The New York Times Company (NYSE: NYT) has signed an agreement to acquire subscription-based sports media business The Athletic for $550 million in cash. San Francisco-based The Athletic provides coverage of more than 200 sports clubs and teams across the world.

The acquisition, which is expected to be completed in the first quarter of this year, is likely to be immediately accretive to the revenue of The New York Times. Additionally, it expects the acquisition to be dilutive to its operating earnings for nearly three years.

Meredith Kopit Levien, the President and CEO of The New York Times, said, “Strategically, we believe this acquisition will accelerate our ability to scale and deepen subscriber relationships. We are now in pursuit of a goal meaningfully larger than 10 million subscriptions and believe The Athletic will enable us to expand our addressable market of potential subscribers.”

Following the completion of the acquisition, The Athletic’s founders Alex Mather and Adam Hansmann will continue as the business’ General Manager and COO, respectively. They will also serve as Co-Presidents of The Athletic, which will operate as a subsidiary but separately from The Times Company.

Both Hansmann and Mather will report to David Perpich, an Executive at The Times Company, while Perpich will become a Publisher of The Athletic.

About The New York Times Company

Media firm The New York Times Company creates, collects and distributes news and information through print and digital products like The New York Times and NYTimes.com. It has over eight million subscribers the world over.

Following the announcement, after the market closed on Thursday, the company’s shares lost 1.4% to end the day at $47.14.

Wall Street’s Take

Last month, Wolfe Research analyst John Janedis downgraded the rating on the stock to Hold from Buy and lowered the price target from $54 to $50 (4.6% upside potential).

The analyst said, “Mid-term investments and a slightly negative mix on weaker print advertising will likely weigh on the stock until there is more investor confidence in the long-term margin trajectory.”

Overall, the stock has a Strong Buy consensus rating based on 3 Buys and 1 Hold. The average The New York Times Company stock forecast of $58.33 implies 22% upside potential. Shares have gained 10.8% over the past six months.

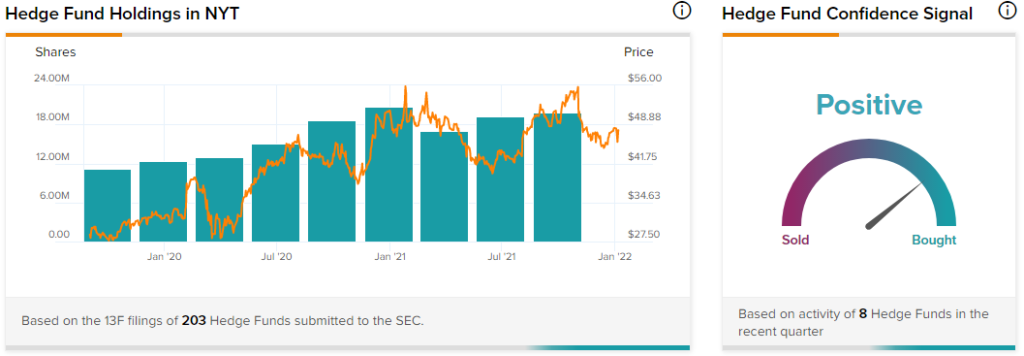

Hedge Fund Activity

TipRanks data shows that Wall Street’s top hedge funds have increased holdings in The New York Times by 601,500 shares in the last quarter, indicating a Positive hedge fund confidence signal in the stock.

Download the TipRanks mobile app now.

Related News:

GameStop Jumps 23% on Crypto & NFTs Plans – Report

Making Sense of AZEK Company’s Newly Added Risk Factor

Coca-Cola Collaborates with Constellation Brands to Launch FRESCA Mixed