The advancements in AI (Artificial Intelligence) and its fast deployment are causing transformative shifts across various industries, including music and entertainment. Nevertheless, this progress has given rise to AI-related risks. One such challenge is the rise of deepfakes. In response to this emerging threat, Alphabet’s (NASDAQ:GOOGL)(NASDAQ:GOOG) Google and Universal Music are engaged in discussions. The Financial Times reported that Google may develop a tool to mitigate the impact of deepfakes.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Before we move ahead, it’s important to understand that deepfakes are media that are digitally altered using AI, mostly without artists’ consent.

Per the report, both companies are in discussion about licensing artists’ voices and melodies for the creation of AI-generated songs. The idea is to develop a tool that will legitimately allow users to create songs or tracks by paying the copyright owners and the artists in the process.

These ongoing discussions are in their preliminary stages, and a product may not hit the market soon. Besides for Universal Music, Google is also in talks with another recording group, Warner Music (WMG), to develop a product that will allow these music label groups to monetize the threat of deepfakes.

Google Unveiled MusicLM

Whether Google, which is mostly at the forefront of every technology trend, will be developing a tool for the music recording groups to monetize their biggest threat remains a wait-and-see story. However, in January, the company unveiled MusicLM, an experimental AI tool that can turn text descriptions into music.

Google said it is working with musicians to explore the possibilities of MusicLM. The tool is available for users to test out.

With Google leveraging its AI innovations across its products and services, let’s look at what analysts recommend for the technology giant.

Is Alphabet a Good Buy Now?

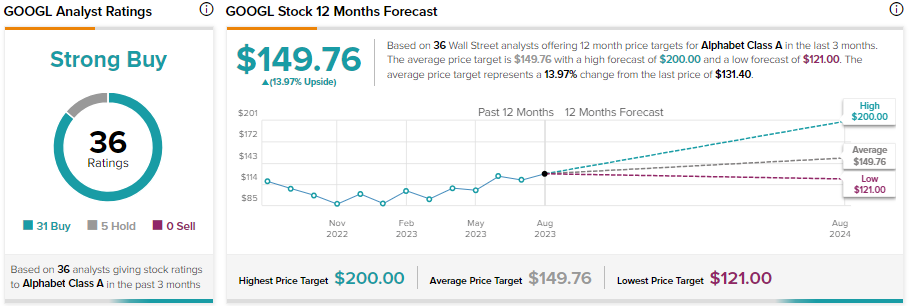

Wall Street analysts are bullish about Alphabet stock, reflecting the strength of its cloud business, AI innovations, and acceleration of Search advertising revenue. It has received 31 Buy and five Hold recommendations for a Strong Buy consensus rating.

GOOGL stock has gained about 49% year-to-date. Meanwhile, analysts’ average price target of $149.76 implies a further upside potential of 13.97% from current levels.