Commercial-stage biopharmaceutical company TG Therapeutics (NASDAQ: TGTX) surged in pre-market trading following the announcement of its preliminary Q4 and FY23 results. The company expects U.S. net product revenues for its novel monoclonal antibody BRIUMVI to be $40 million and $89 million in the fourth quarter and FY23, respectively. Analysts were expecting the company to report Q4 revenues of $36.8 million.

TG Therapeutics is targeting U.S. BRIUMVI net product revenues in the ranges of $41 million to $46 million and $220 million to $260 million for the first quarter and FY24, respectively.

In FY24, TGTX is looking at starting the clinical development of subcutaneous BRIUMVI and will examine BRIUMVI in additional autoimmune diseases outside of Multiple Sclerosis (MS).

Is TGTX a Good Stock to Buy?

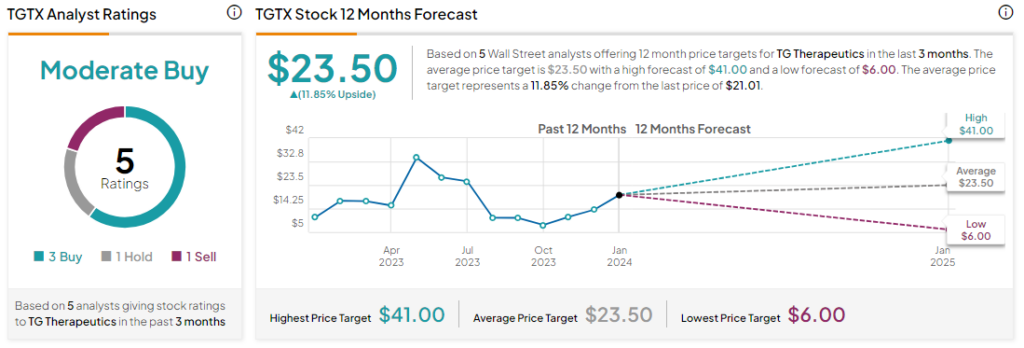

Analysts remain cautiously optimistic about TGTX stock with a Moderate Buy consensus rating based on three Buys and one Hold and Sell each. TGTX stock has surged by more than 70% over the past year, and the average TGTX price target of $23.50 implies an upside potential of 11.85% at current levels.