Texas Instruments’ (TI) fourth-quarter sales rose 22% to $4.1 billion year-on-year, and exceeded analysts’ estimates of $3.6 billion. The revenue increase was driven by strong demand for the company’s semiconductors and ICs (integrated circuits) in personal electronics, automotive and industrial markets.

The IC maker’s analog business segment, which manufactures analog semiconductors, generated sales of $3.1 billion in 4Q20, a rise of 25% year-on-year. The company’s processing segment, which produces embedded processors like microcontrollers, had revenues of $720 million, a growth of 14% year-on-year.

Texas Instruments’ (TXN) CEO Rich Templeton commented, “Our cash flow from operations of $6.1 billion for the year again underscored the strength of our business model. Free cash flow for the year was $5.5 billion and 38% of revenue. This reflects the quality of our product portfolio, as well as the efficiency of our manufacturing strategy, including the benefit of 300-millimeter Analog production.”

“TI’s first quarter outlook is for revenue in the range of $3.79 billion to $4.11 billion and earnings per share between $1.44 and $1.66. We continue to expect our 2021 annual operating tax rate to be about 14%,” Templeton added. (See TXN analysis on TipRanks)

Mizuho Securities analyst Vijay Rakesh reiterated a Hold rating on the stock on Jan. 26 and set a price target of $175. Rakesh commented on the results, “TXN, the #1 global analog supplier, reported a BIG DecQ ~$4.1B top line (consensus $3.6B) driven by Auto up 25% y/y and industrial up 16% y/y BUT Comm down 28% q/q and 8% y/y, potentially with Huawei headwinds. TXN also guided to a BIG MarQ $4.0B (consensus $3.6B) – we believe with continued Auto-industrial strength – positive for the peer supply chain with ON, NXPI, ALGM and MCHP.”

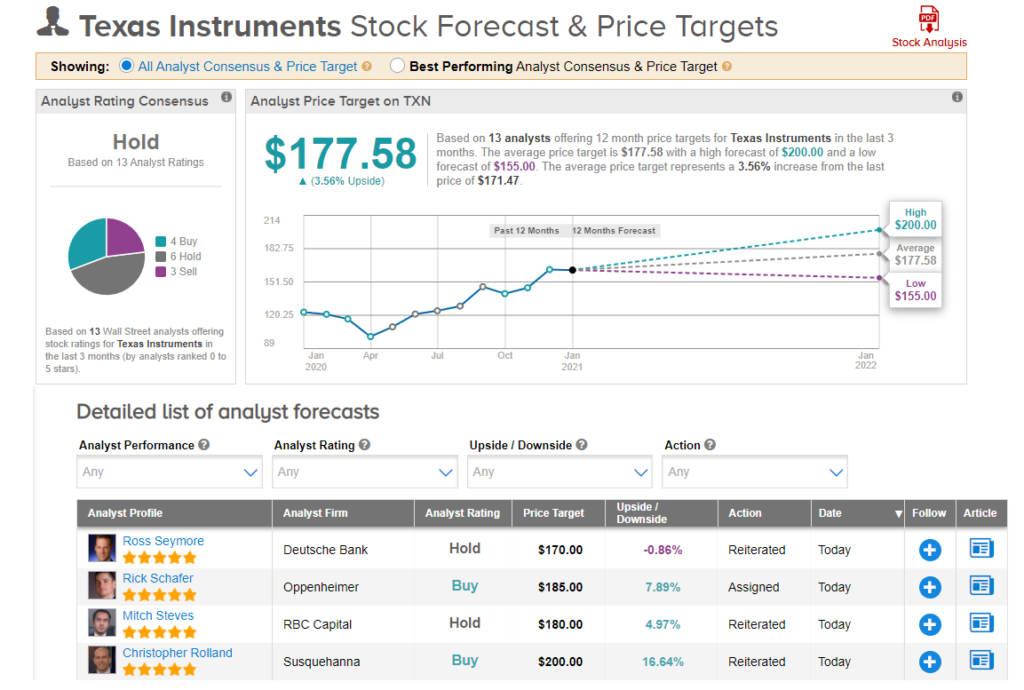

Wall Street analysts are sidelined on the stock and the consensus is a Hold with 6 analysts recommending a Hold, 3 analysts suggesting a Sell, and 4 analysts say Buy. The average price target of $177.58 implies 3.6% upside potential to current levels. Shares are up by 6.1% over the past month.

Related News:

Verizon Adds Fewer Postpaid Subscribers Than Expected In 4Q; Shares Drop

3M Posts Surprise 4Q Profit Amid Strong Demand For Face Masks

Tilray To Supply Medical Cannabis To France; Shares Gain 14%