Tesla (NASDAQ: TSLA) continued to do well in China in March and sold 88,869 units of China-made electric vehicles (EV) for both domestic sales and exports, up 35% year-over-year, according to data from the China Passenger Car Association (CPCA). This vehicle delivery number increased by 19.4% month-over-month.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In contrast, the Warren Buffett– backed BYD sold 206,089 units in March, soaring by 97.5% year-over-year.

A Reuters report cited data from China Merchants Bank International (CMBI) that indicated that Tesla could have a best-ever quarter in China as its retail sales totaled 122,801 units as of March 26 and made up 13% of China’s new energy car sales, which includes both pure electric and plug-in hybrid cars.

Even in the U.S., the EV major reported record Q1 deliveries.

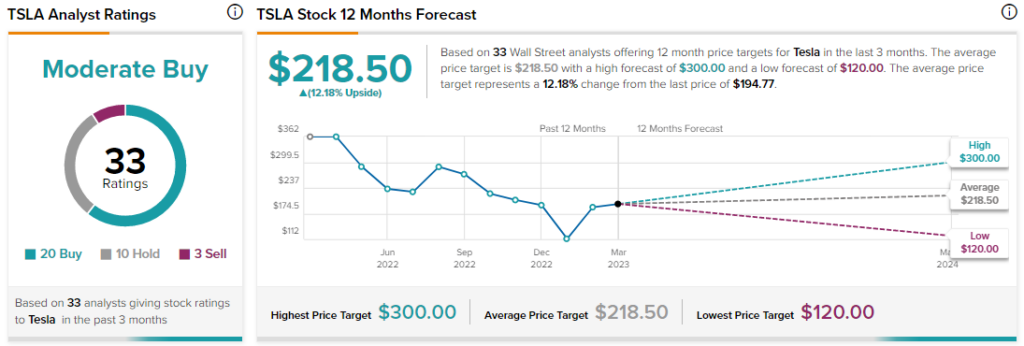

Analysts are cautiously optimistic about TSLA stock with a Moderate Buy consensus rating based on 20 Buys, 10 Holds, and three Sells.