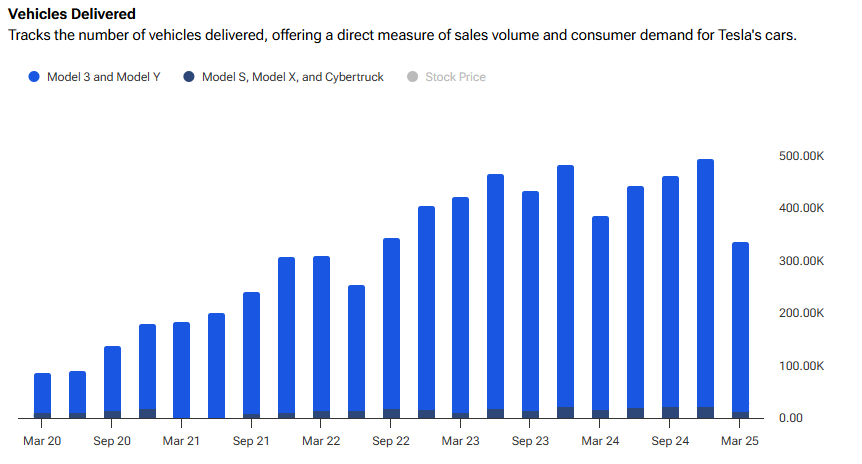

Tesla (TSLA) delivered 384,122 vehicles in Q2 2025, down 14% from the same period last year. This marks the second consecutive quarterly drop in deliveries. Production hit 410,244 units, exceeding deliveries by over 26,000 vehicles, adding to the company’s growing inventory.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The majority of production and deliveries came from the Model 3 and Model Y, with 396,835 produced and 373,728 delivered. Other models, including the Cybertruck, accounted for 13,409 units produced and 10,394 delivered. Tesla does not break out sales by region or provide model-level financial data.

Analysts expected around 387,000 deliveries, according to FactSet (FDS). Although the actual figure fell short of the target, it came in higher than many investors had feared. Shares rose 3% following the report, trading at $309.27 in early Wednesday action. Despite the bounce, the stock is still down 23% year-to-date.

Competition, Politics, and Recalls Weigh on Sentiment

Several headwinds continue to affect Tesla. In Q1, some buyers held off on purchases to wait for the refreshed Model Y, which started shipping in March. The company also faces increasing competition from Chinese EV makers offering newer and more affordable models. Political backlash has also added pressure. CEO Elon Musk’s support for controversial causes and his recent public split with President Trump have weighed on Tesla’s reputation. Some policy proposals could also reduce EV subsidies, which may hit future demand.

Meanwhile, the Cybertruck has faced a bumpy rollout. Since its November 2023 launch, the vehicle has been recalled eight times for hardware and software issues. The company did not comment on ongoing challenges related to quality control.

Investors will get a clearer picture of Tesla’s profitability and cash flow when the company reports its full Q2 earnings on July 23. While deliveries are still declining year-over-year, some analysts believe Q2 could mark the bottom. Sentiment appears cautiously optimistic, but growth from here may depend on pricing power, operational efficiency, and policy direction in major EV markets.

Is Tesla a Buy, Sell, or Hold?

Turning our attention to Wall Street, Tesla is considered a Hold based on 34 ratings. The average price target for TSLA stock is $287.39, implying a 5.50% downside potential.