Often it pays to listen to the wisdom of the crowd. The sports fans who urge in unison for the forward to shoot on goal or to dive to the left to save the penalty.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

An individual can feel safe in the noise, comfort and camaraderie of the crowd.

It can also work in the world of investing. Sure, being a lone-wolf trading genius has its advantages, but also its risks.

Crowd Wisdom

Investors can also use the wisdom of the crowd through a TipRanks tool we creatively call ‘Crowd Wisdom.’

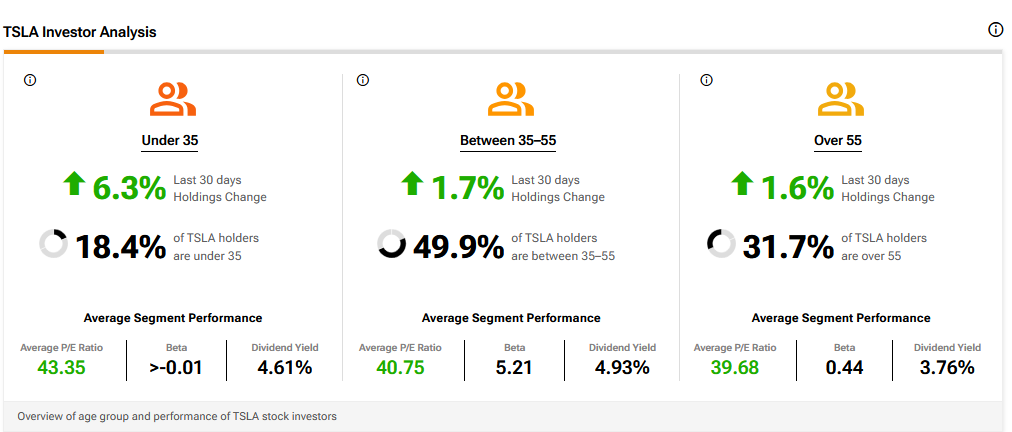

Let’s see what it shows for those investors deliberating the prospects of EV giant Tesla (TSLA).

We base this data on sentiment and activity around the stock in 825,071 investor portfolios. It shows that over the last 30 days the number of portfolios holding Tesla stock is up 1.9%. However, over the last 7 days it is up by only 0.2%.

During that period we have had Tesla’s Q3 earnings. The EV maker delivered record revenue and free cash flow despite a sharp 31% decline in the bottom line. It delivered adjusted earnings of $0.55 per share.

Also, the bottom line declined 31% on a year-over-year basis. Revenues rose by 12% year-over-year to $28.1 billion and surpassed the analysts’ estimates of $26.33 billion.

There has also been renewed discussion about the merits of chief executive Elon Musk’s pay packet. His proposed $1 trillion pay package for 2025 is in the balance with the risk of Musk stepping down if shareholders say no to the increase.

Positive Sentiment

Despite that, investor sentiment in the recent quarter is described as being positive. Some of the most positive have been people in the under 35 age bracket with a 6.5% increase in holdings and those between 35 and 55 with a 1.7% rise. Those over 55, who represent a third of all Tesla investors, have recorded a 1.6% rise.

TipRanks data also shows what Tesla investors bought over the last 7 and 30 days. Top of the list is e-commerce firm Shopify (SHOP), followed by Disney (DIS), CVS Health (CVS) and Starbucks (SBUX).

Is TSLA a Good Stock to Buy Now?

On TipRanks, TSLA has a Hold consensus based on 14 Buy, 11 Hold and 9 Sell ratings. Its highest price target is $600. TSLA stock’s consensus price target is $383.66, implying a 16.70% downside.