On April 17, Goldman Sachs analyst Mark Delaney gave his initial opinion on Tesla’s (NASDAQ:TSLA) unexpected update about its Full Self Driving (FSD) offering and Robotaxi launch, which he believes will take years to reap benefits. While Delaney maintained a Hold rating on the electric vehicle (EV) maker, the five-star analyst did share his thoughts on the two key potential drivers.

Delaney ranks 221 out of more than 8,700 analysts ranked on TipRanks. He also boasts an attractive 17.80% average return per rating in the past year, with a success rate of 61%.

FSD, Robotaxi Not Ready for Commercialization

Billionaire CEO Elon Musk is known to throw surprises on his social media site X. This time, he took investors by storm by announcing that Tesla is lowering the price of its FSD package by half from $199 per month to $99. Moreover, Musk abruptly announced August 8, 2024, as the launch date for Robotaxi.

Interestingly, Delaney believes that Tesla is indeed one of the best in the autonomy/ADAS (advanced driver-assistance system) technology space and is poised to benefit in the long run from AI (artificial intelligence) advancements and FSD opportunities. That said, the analyst says that, based on his model estimates, it will take years for Tesla to truly see considerable revenue growth from either Robotaxi or FSD.

For Robotaxi, Delaney contends that Tesla needs to achieve at least L3 (Conditional Driving Automation) capability with FSD to bolster adoption even at the price of $99 a month. Secondly, the analyst believes that Tesla’s Robotaxi is in the very early stages of commercialization, with pending permits that have to clear rigorous regulatory screening procedures.

Further, the NHTSA governs the tough laws regarding autonomous driving that vary in each state with a history of hiccups faced by competing companies. As reports suggest, Tesla has not yet approached the regulatory bodies in important states such as California, Arizona, and Nevada. This means Tesla is a long way from commercializing Robotaxi and benefiting from its investments.

On the positive side, Delaney highlighted that the total addressable market (TAM) for rideshare in North America is estimated to grow at a 7% CAGR (compound annual growth rate) from 2023 to 2029, reaching $300 billion. Tesla, per se, is expected to benefit on the cost front by leveraging its in-house low-cost generation platform and reduced sensor inputs.

In terms of valuation, Delaney noted that the $175 (12.6% upside) price target, which he recently cut from $190, already includes the long-term value from Tesla’s software-related businesses, such as selling FSD to its own customer base.

What is the Price Target for Tesla?

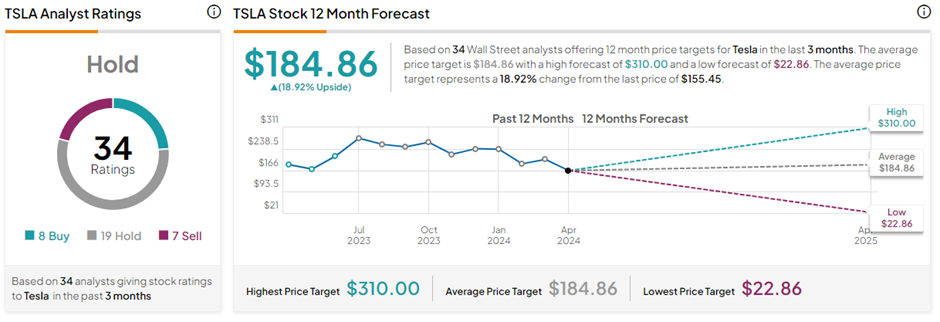

On TipRanks, the average Tesla price target of $184.86 implies 18.9% upside potential from current levels. Also, TSLA stock has a Hold consensus rating based on eight Buys, 19 Holds, and seven Sell ratings. TSLA stock has lost 37.4% so far in 2024, reflecting concerns about subdued demand amid growing competition and margin pressures.

Ending Thoughts

Unfortunately, TSLA stock is being hammered from all sides currently. The news of 10% job cuts, missing Q1 delivery estimates, the shareholder voting on Musk’s pay package, and the delayed delivery of Cybertrucks have spooked investors. In this scenario, the good news about the FSD price cut and the Robotaxi launch could drive investor interest. While Delaney has a Hold rating on Tesla currently, he is optimistic about Tesla’s long-term value proposition.