Tesla Inc. plans to launch the production of electric vehicle (EV) chargers in China in 2021, as the company seeks to step up sales in the world’s biggest car market, Reuters has learnt.

According to a document submitted to the Shanghai authorities and seen by Reuters, Tesla (TSLA) plans to invest 42 million yuan ($6.4 million) in a new factory, to make the chargers, also known as charging piles, near its car plant in Shanghai. The move comes as the electric vehicle maker now sells its Model 3 electric cars in China with a target to deliver its Model Y sport utility vehicles in 2021.

The factory, which Tesla expects to complete in February, will have capacity to make 10,000 chargers a year, according to the filed document. For now, the company can only import the chargers, usually installed in charging stations or car parks, from the US.

China, which offers hefty subsidies for electric vehicles as it seeks to cut down on pollution from petrol or diesel cars, has been expanding its nationwide network of charging points, one of the biggest challenges to encouraging adoption of EVs.

Tesla, which sold over 13,000 vehicles in China last month, did not immediately respond to a request for comment by Reuters.

Meanwhile, the Shanghai car factory, earmarked as central to Tesla’s global growth strategy, seeks to produce 150,000 Model 3 sedans this year and has started exporting some vehicles to Europe.

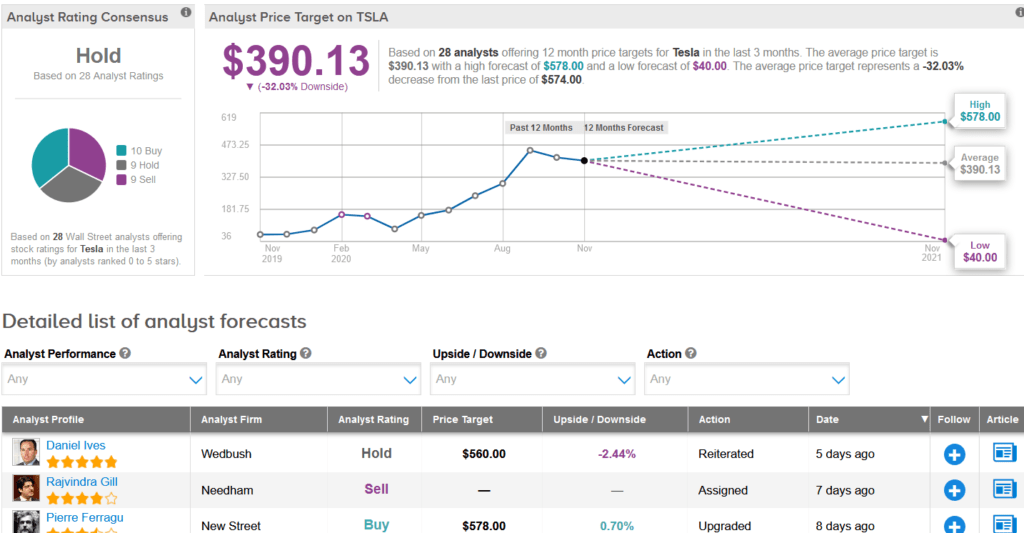

Tesla shares are up a stellar 586% year-to-date, leaving the Street sidelined on the stock. The Hold analyst consensus breaks down into 9 Holds, 9 Sells and 10 Buys. That’s with an average price target of $390.13 implying 32% downside potential lies ahead over the coming 12 months.

On Nov. 22, Wedbush analyst Daniel Ives ramped up the stock’s price target to $560 from $500, while reiterating a Hold rating, saying that Tesla’s “bull story is now all about a stepped up EV demand trajectory into 2021.”

“China remains a greenfield EV market opportunity as we believe overall EV sales can potentially double in the region over the next few years given the pent-up demand for EV vehicles across all price points,” Ives wrote in a note to investors. “We believe China could see eye popping demand into 2021 and 2022 across the board with Tesla’s flagship Giga 3 footprint a major competitive advantage, as domestic players such as BYD, Nio, Xpeng, and Li also are also firing on all cylinders and should clearly benefit.”

Related News:

Tesla Pops 13% On S&P 500 Inclusion; Stock Up 388% YTD

Tesla To Recall 29,193 Vehicles In China Due To Suspension Defect

Tesla 3Q Profit Blows Past Estimates; Street Says Hold