Tesla’s (TSLA) Chinese ambitions have been given a boost today after chief executive Elon Musk said authorities there were ready to give the green light to its Full Self-Driving software.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Full Gas

“We have partial approval in China, and hopefully we’ll have a full approval in China around February or March or so,” Musk told the company’s annual general meeting on Thursday ahead of his successful pay package vote.

China’s industry ministry did not respond to Musk’s claim, but if approval is given then it would be a huge fillip for Tesla growth in what has been a challenging market this year.

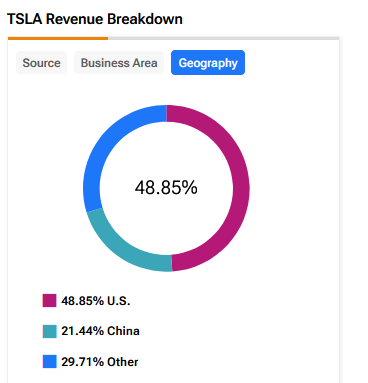

It has seen its China market share slump to 8% as of last quarter compared with a peak of 15.4% in the first quarter of 2023. But it remains a key country for the group – see below:

Over the past few years, Tesla has allowed Chinese customers to purchase the FSD software package for RMB 64,000 ($8,990). Yet since FSD is essentially unusable in China, even Tesla sales staff do not recommend customers purchase the feature.

By contrast, most domestic automakers – including XPeng (XPEV) and BYD (BYDDY), provide their ADAS (Advanced Driver Assistance System) features free of charge to owners.

FSD Issues

The Tesla system, known as FSD for short, has been partially approved in China since this February. Before that Tesla owners could use a less advanced and cheaper autopilot option.

That means that it is not allowed to change gears, meaning the vehicle can’t complete a trip from one parking space to another completely on its own in China. The system has also had difficulties in identifying local traffic signs on Chinese roads.

FSD has also had its barriers in the U.S. with the U.S. National Highway Traffic Safety Administration (NHTSA) launching an investigation into the system. The probe, which covers 2.88 million vehicles, comes amid reports of traffic violations linked to the system, prompting both regulators and investors to take notice.

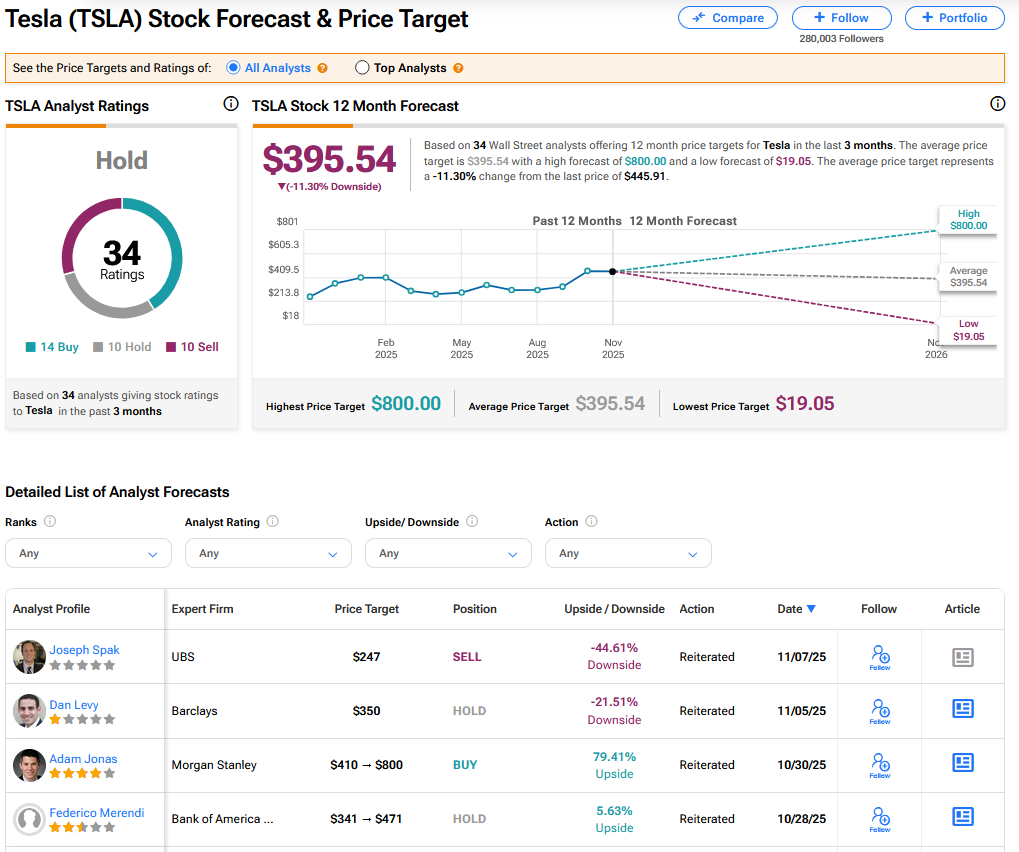

Is TSLA a Good Stock to Buy Now?

On TipRanks, TSLA has a Hold consensus based on 14 Buy, 10 Hold and 10 Sell ratings. Its highest price target is $800. TSLA stock’s consensus price target is $395.54, implying an 11.30% downside.