It wasn’t so long ago that we heard from electric vehicle stock Tesla’s (NASDAQ:TSLA) CEO Elon Musk about how Tesla had made some of its line workers into millionaires thanks to the surge in their stock prices. We can only hope that most of the roughly 2,700 jobs recently cut in Austin were on that list. This move gave shares a boost, sending Tesla up around 2% in the closing minutes of Tuesday’s trading.

A Worker Adjustment and Retraining Notification (WARN) Act notice revealed that Tesla is dropping about 12% of its workforce in its Austin, Texas, factory. The layoffs are part of a larger corporate restructuring effort, reports note, and came about in part thanks to declining overall sales figures for Tesla’s lines of electric vehicles.

Since Musk himself, not so long ago, referred to the Austin plant as a “gigantic money furnace,” it was a pretty safe bet that it would be the target of some cost-cutting efforts before too much longer. Musk also referred to a German assembly plant by a similar name, which suggests it will be the next target of budget axes.

Improving the Product Line

Meanwhile, Tesla is working to address sluggish sales with product improvements. The new Tesla Model 3 is said to have a 0 – 60 speed of 2.9 seconds and packs 510 horsepower under its hood. Impressive by any standard, and for those who want to buy in, it’s available to order now.

However, there are some less-than-encouraging issues afoot for Tesla, as a driver who ran over a motorcyclist while the Autopilot system was engaged has been arrested for homicide. The Tesla driver was using his phone while the car drove. Even as Tesla works to improve autopilot functionality, it still produces tragedies like this, which inevitably set the concept back each time.

Is Tesla a Buy or Sell?

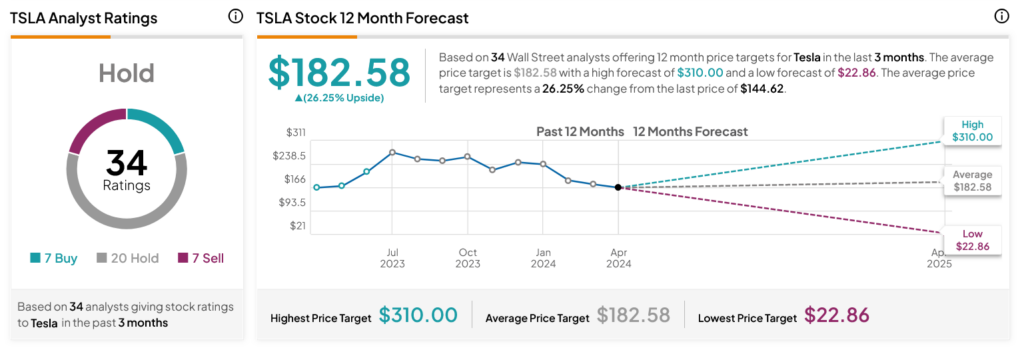

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on seven Buys, 20 Holds, and seven Sells assigned in the past three months, as indicated by the graphic below. After a 10.91% loss in its share price over the past year, the average TSLA price target of $182.58 per share implies 26.25% upside potential.