Elon Musk-led electric vehicles maker Tesla (NASDAQ:TSLA) is planning capital expenditure (capex) of $7 billion to $9 billion in each of the next two years, up from the estimated capex in the range of $6 billion to $8 billion this year, as per the company’s 10-K filing with the SEC. Tesla is increasing its capital spending to ramp up production at its manufacturing facilities in three continents.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Additionally, Tesla is also investing in the development of new EV models and battery cell technologies. The company recently announced that it would be investing an additional $3.6 billion to continue the expansion of Gigafactory Nevada. Tesla has invested $6.2 billion in Nevada since 2014. It aims to add 3,000 new employees and build two new factories in Nevada – a 100 GWh 4680 cell factory with an annual capacity to produce enough batteries for 2 million light-duty vehicles and a first high-volume factory to build Semi trucks.

Tesla’s capital spending came in at $7.16 billion in 2022, up from $6.48 billion in 2021, as the company invested in capacity expansion. During the Q4 earnings call, CEO Musk assured investors that the demand for Tesla’s vehicles “far exceeds production.” He added that the company is making “some small price increases as a result.” Tesla recently announced price cuts in China, U.S., and Europe to boost demand.

Other Disclosures

Meanwhile, Tesla also disclosed in its 10-K annual filing that it recorded impairment losses of $204 million in 2022 related to its Bitcoin (BTC-USD) holdings and gains of $64 million on certain conversions of Bitcoin into fiat currency.

Furthermore, the company confirmed that it has received requests from the U.S. Department of Justice (DOJ) for documents related to its Autopilot and Full Self-Driving (FSD) features. Recently, Reuters reported that Tesla’s director of autopilot software testified that a 2016 video used by the company to promote its self-driving technology was staged.

Is Tesla Stock a Good Buy?

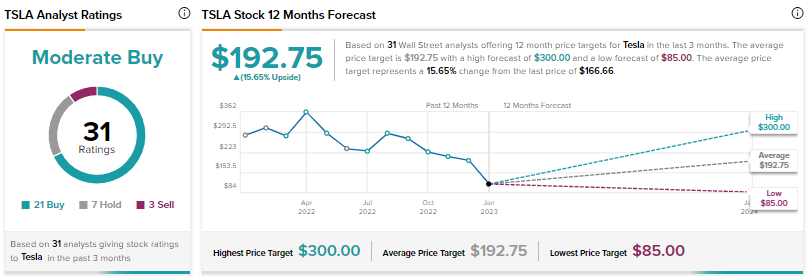

The Street’s Moderate Buy consensus rating for Tesla stock is based on 21 Buys, seven Holds, and three Sells. The average TSLA stock price target of $192.75 implies 15.7% upside potential. Shares have rallied over 35% since the start of this year.