The electric vehicle (EV) behemoth Tesla (NASDAQ:TSLA) is set to release its Fiscal fourth quarter 2022 results on January 25, after the market closes. The Street expects Tesla to post diluted earnings of $1.15 per share on revenues of $24.24 billion. This represents an improvement over the Q3FY22 results, when Tesla reported diluted earnings of $1.05 per share on revenues of $21.45 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Factors including higher interest rates, persistent inflationary pressure, subdued consumer demand, and expectations of slower economic growth could have affected Tesla’s quarterly performance to some extent. However, Tesla shares have gained nearly 33% so far this year, compared to losing 53.6% over the past year.

What Analysts and Investors Will Be Looking For

Recently, Tesla lowered the prices of EVs in China for the second time and in the U.S. by nearly 20%. Both analysts and investors will be looking out for more information on how this price decline has helped boost EV deliveries. Also, any update on the impact on margins due to the price cuts will be appreciated. Furthermore, clarity will be sought on how the EV tax credit (up to $7,500), which came into effect on January 1, 2023, has helped propel buyers’ purchase decisions.

Importantly, Tesla’s stock price has taken a beating due to CEO Elon Musk’s Twitter purchase and Tesla share sale. Investors will also appreciate clarity on these two aspects to see if and how the stock price will be impacted in the future.

Will Tesla’s Stock Go Up in 2023?

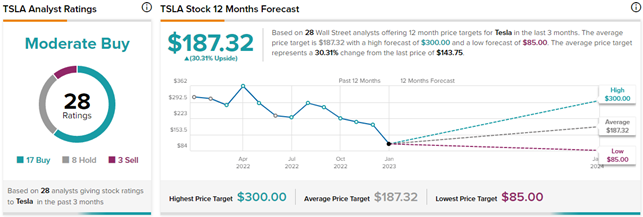

Owing to the several factors mentioned above, analysts have a mixed outlook on TSLA stock. Interestingly, 17 of the 28 analysts on TipRanks have rated Tesla a Buy but a few of these analysts have lowered their price target expectations for 2023.

Yesterday, UBS analyst Patrick Hummel slashed the price target on the stock to $220 (53% upside) from $350 while maintaining a Buy rating.

Similarly, Truist Financial analyst William Stein lowered the price target to $245 (70.4$ upside) from $299 and reiterated a Buy rating.

Overall, analysts have a Moderate Buy consensus rating on Tesla based on 17 Buys, eight Holds, and three Sell ratings. On TipRanks, the average Tesla price forecast of $187.32 implies 30.3% upside potential from current levels.

Join our Webinar to learn how TipRanks promotes Wall Street transparency