Shares of EV major Tesla (NASDAQ:TSLA) are trending lower today following the company’s disclosure of capital expenditure expectations of over $9 billion for 2023.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Tesla also expects capital expenditures to be in the range of $7 billion to $9 billion for each of the next two Fiscal years. The company added that its business has consistently generated cash flow from operations in excess of its capital spending levels. Its positive cash generation is also receiving a boost from sales growth and shorter days sales outstanding than days payable outstanding.

Impressively, Tesla is simultaneously ramping up new products, setting up or ramping up facilities on three continents, growing its supercharger network, and piloting the development of new battery cell technologies.

The company noted that the long-term success of its energy generation and storage business hinges on driving margins through greater volumes. It is focusing on increasing the production of energy storage products. The company has announced a new Megafactory in Shanghai and is ramping up its Megafactory in California.

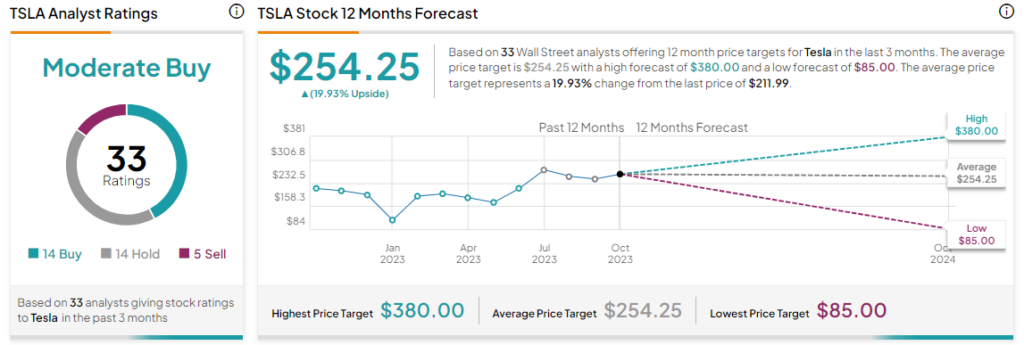

What Is the Forecast for TSLA Stock?

Overall, the Street has a Moderate Buy consensus rating on Tesla. The average TSLA price target of $254.25 implies a nearly 20% potential upside. Tesla’s shares have been under pressure over the past week, after its third-quarter numbers failed to impress investors.

Read full Disclosure