Shares of Tesla (NASDAQ:TSLA) gained in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2023. Earnings per share came in at $0.66, which missed analysts’ consensus estimate of $0.73 per share. Sales increased by 8.9% year-over-year, with revenue hitting $23.35 billion. This missed analysts’ expectations by $790 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

When comparing free cash flow and capital expenditures on a quarter-over-quarter basis, we can see that expenses climbed and profitability fell. Indeed, capital expenditures rose from $2.06 billion to $2.46 billion, while free cash flow dipped to $848 million from $1 billion. Nevertheless, Tesla still expects full-year deliveries of 1.8 million vehicles.

Is Tesla Stock a Buy?

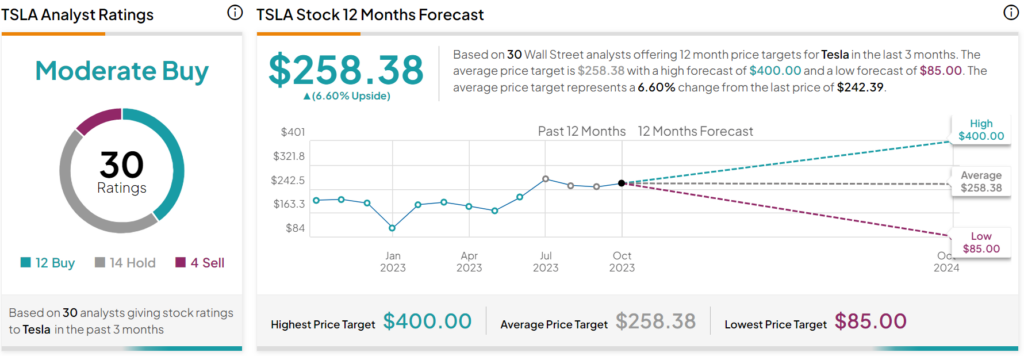

Turning to Wall Street, analysts have a Strong Buy consensus rating on Tesla stock based on 12 Buys, 14 Holds, and four Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average Tesla price target of $258.38 per share implies 6.6% upside potential.