Tesla (TSLA) and the National Highway Traffic Safety Administration (NHTSA) are not seeing eye-to-eye on what autonomous driving should be all about. Bloomberg reports that the U.S. auto safety regulator’s new standards on automated driving systems are more conservative than what Tesla would like. TSLA shares fell 5.12% to close at $795.35 on March 11.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla is a U.S. company that designs, manufactures, and sells electric vehicles. It also deals in solar energy generation systems and energy storage products.

Tesla vs. NHTSA

The agency has released a 155-page rule that eliminates the need for manual driving controls in self-driving cars to meet crash standards. However, failure to be as radical as Tesla would like has seen the regulator come under scrutiny.

Tesla insists that the regulator should consider the possibility that autonomous vehicles may eventually be operated remotely, using mobile phones, tablets, or joysticks. The regulator insists the automaker is getting ahead of itself as manually operated driving controls should only include proven and tested systems. According to the NHTSA, manually operated driving controls cannot account for the use of tablets or cell phones as such systems are yet to be tested.

The standoff comes amid ongoing investigations into possible defects on the Tesla Autopilot feature. The electric vehicle giant has also been asked to share information on the release of a beta version of the Full Self Driving (FSD) feature.

Stock Rating

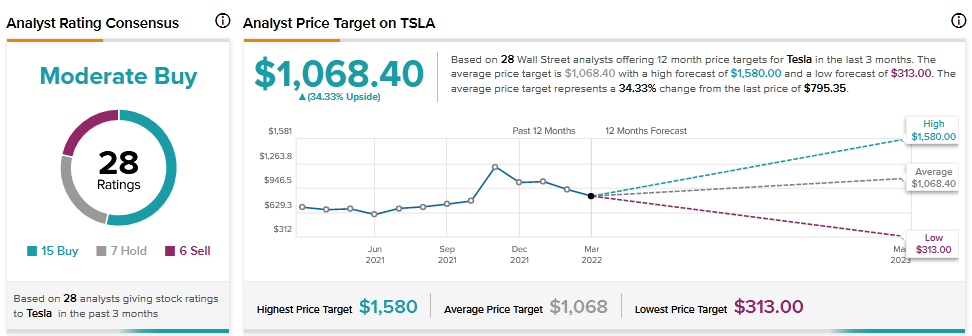

Last week, Piper Sandler analyst Alexander Potter reiterated a Buy rating on Tesla with a $1,350 price target, implying 69.74% upside potential to current levels. According to the analyst, exposure to the Chinese market is a positive for Tesla. However, if American companies are eventually used as pawns amid deteriorating U.S.-China relations, then shareholders would likely suffer.

Consensus among analysts is a Moderate Buy based on 15 Buys, 7 Holds, and 6 Sells. The average Tesla price target of $1,068.40 implies 34.33% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.

Related News:

SIG Plc Posts Higher Revenue, Smaller Loss

CGI Concludes Deal to Acquire Umanis

Wheaton Precious Metals Q4 Revenue and Profit Shrink