An “environmentally friendly Bitcoin stock” probably sounds like a great idea to a lot of investors out there. We know what it takes to mine even a single Bitcoin in this day and age, and often immediately thereafter, berate ourselves for not mining Bitcoin back when it was a much simpler process. But TeraWulf (NASDAQ:WULF) is making the process a little easier, and that’s drawing both attention and investment, with TeraWulf up at the time of writing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The big gain for TeraWulf came as Northland Capital Markets, by way of analyst Mike Grondahl, officially kicked off coverage of the Bitcoin miner by declaring it an “outperform.” Grondahl noted that there were several factors working in TeraWulf’s favor, starting with a general improvement in the cryptocurrency market. From there, Grondahl went on to detail several key factors unique to TeraWulf, including its ability to improve capacity through the strategic use of mergers and acquisitions, its ability to generate its own power for mining, and its solid revenue growth history.

The combination of digital currency and environmental sustainability is likely to prove an irresistible prospect for investors, particularly those who pay close attention to Environmental, Social, and Governance (ESG) ratings. Though TeraWulf lost quite a bit of its gains today—this morning, it was up over 20% at one point—it’s still holding on to enough of those gains to make itself worthwhile. Just back in June, it announced that it had increased its hashrate capacity by over 25% and mined 347 Bitcoin in June alone. That’s up 8% from only May and brought TeraWulf to 1,441 Bitcoin mined in that year.

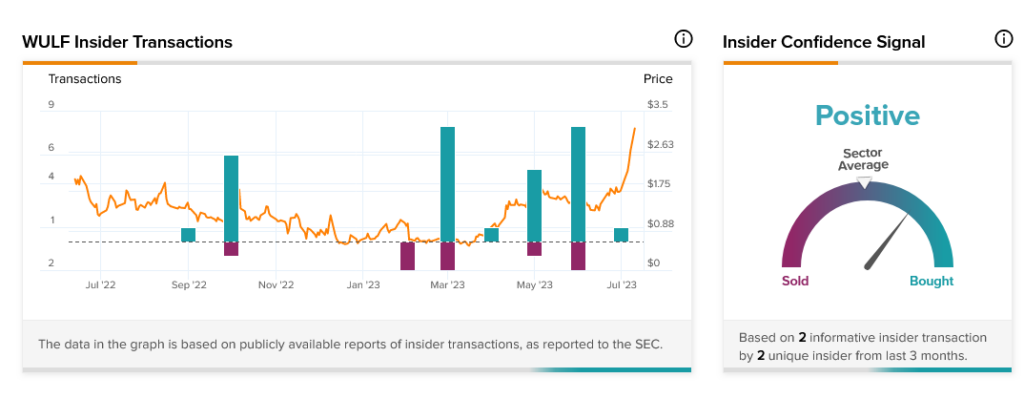

Better yet for investors, insiders are also buying in. Insider trading at TeraWulf shows that insiders are buying in substantial proportions and easily outmatching sellers. Currently, insider confidence is considered “Positive” as insiders added $144,500 in shares to their portfolios just in the last three months.