Over the past year, Tencent Music Entertainment Group (NYSE: TME), a company that develops music streaming services for the Chinese market, experienced a significant loss in value with shares plummeting by around 73%. Increased competition and mounting regulatory pressures were among the notable factors for the downtrend.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Though the end to this unfavorable phase is not known, Tencent Music could possibly recover in the near-term on the back of the popularity of its services both in China and globally. Being the owner of the most popular and original music platforms in China such as QQ Music, Kugou Music, Kuwo Music, and National K Song, the company is striving to “build an immersive music entertainment ecosystem, bringing music lovers innovative possibilities for how they listen, watch, sing and play.”

Earnings Numbers

TME reported earnings per ADS of RMB 0.37 ($0.06), in line with the consensus estimate. The company reported earnings per ADS of RMB 0.54 in the same quarter last year.

Total revenues of RMB 6.64 billion ($1.05 billion) decreased 15.1% from the year-ago period. The consensus estimate stood at $1.1 billion.

Revenues from online music services came in at RMB 2.62 billion ($413 million), down 4.8%. Additionally, revenues from music subscriptions grew 17.8% to RMB 1.99 billion ($314 million) on the back of a 31.7% growth in the number of paying users, which reached 80.2 million.

Revenues from social entertainment services and others stood at RMB 4.03 billion ($635 million) in the quarter, down 20.6% year-over-year, as paying users plunged by 26.5% despite ARPPU showing a rise.

Gross margin was 28% in the quarter, down 350 basis points year-over-year.

As of March 31, 2022, the company’s cash, cash equivalents, term deposits, and short-term investments stood at RMB 25.93 billion ($4.09 billion), up from RMB 24.69 billion as of December 31, 2021.

Capital Deployment

Under the 2021 Share Repurchase Program, as of May 13, 2022, TME has repurchased around 73.3 million ADSs for a total value of $674 million.

Official Comments

Looking forward, the CEO of TME, Mr. Ross Liang, said, “We will continue to make our ecosystem, content, products and services differentiated and highly specialized. This, in turn, will help us better serve hundreds of millions of music lovers, music creators and the music industry as a whole, and unlock the massive opportunity in front of us.”

Wall Street’s Take

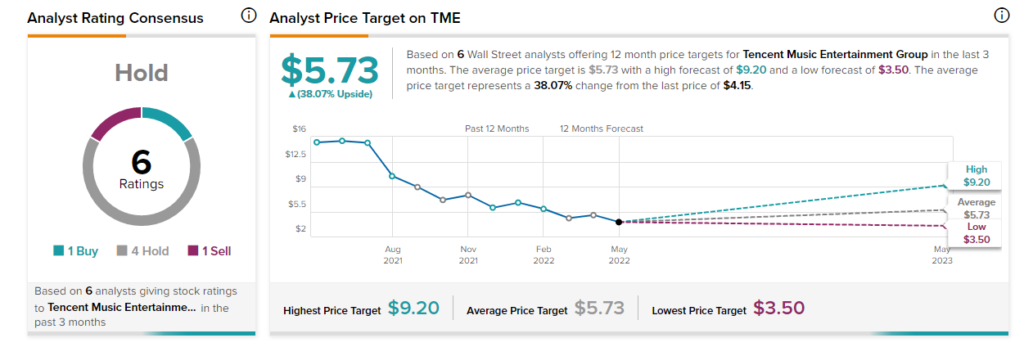

Overall, the stock has a Hold consensus rating based on one Buy, 4 Holds, and one Sell. The average Tencent Music price target stands at $5.73 and implies a 12-month upside potential of 38.07% from early Tuesday trading levels.

Bottom-Line

With decent analyst ratings, recent earnings results, and stock price performance, investors looking at buying the dips might consider adding Tencent Music to their portfolios for significant long-term gains.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

Moderna’s New CFO Departs on Legal Issues

Large Layoffs at Alibaba-Russia Joint Venture

Eli Lilly’s Mounjaro Injection Bags FDA Approval