Healthcare companies form an integral part of today’s world mainly post-pandemic. They are striving hard to bring innovative and successful medications to the market to increase the survival of humans by treating them acutely.

Eli Lilly and Company (NYSE: LLY) is one such American pharmaceutical company, whose Mounjaro (tirzepatide) injection has been recently approved by the U.S. Food and Drug Administration (FDA) for adults with type 2 diabetes. The injection will likely be available in the United States in the coming weeks.

Mounjaro is the first-of-its-kind GIP (glucose-dependent insulinotropic polypeptide) and GLP-1 (glucagon-like peptide-1) receptor agonist. It is designed as an adjunct to diet and exercise once weekly, which in turn, will improve glycemic control in adults with type 2 diabetes.

Importantly, Mounjaro cannot be used for patients with type 1 diabetes mellitus, and is not indicated for patients with a history of pancreatitis.

Supporting Data

The U.S. regulator’s approval followed results from the phase 3 SURPASS program. It evaluated the efficacy of Mounjaro 5 mg, 10 mg, and 15 mg to be taken alone or combined with normal diabetes medications. Delivering superior A1C reductions compared with all comparators in phase 3 SURPASS clinical trials, Mounjaro resulted in reducing weight significantly versus comparators in the key secondary endpoint.

Additionally, regulatory reviews are ongoing for Mounjaro to treat type 2 diabetes in Europe, Japan, and various other markets.

Official Comments

Encouragingly, Eli Lilly’s President at Lilly Diabetes, Mike Mason, said, “We are thrilled to introduce Mounjaro, which represents the first new class of type 2 diabetes medication introduced in almost a decade and embodies our mission to bring innovative new therapies to the diabetes community.”

Analysts Recommendation

Following the FDA’s approval, Mizuho Securities analyst Vamil Divan reiterated a Buy rating on the stock with a price target of $356 (22.07% upside potential).

Divan commented, “We continue to see Lilly as a best-in-class story in large cap biopharma, driven by diversified nearterm growth, minimal exposure to patent expirations, and a wave of attractive late-stage pipeline assets, led by Mounjaro.”

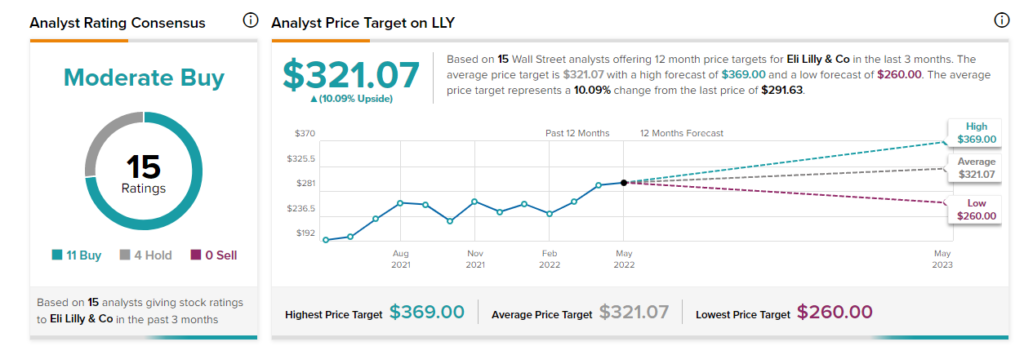

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 11 Buys and four Holds. The average Eli Lilly price target of $321.07 implies 10.09% upside potential. Shares have jumped more than 51% over the past year.

Bloggers Weigh in

Bloggers seem enthused by the company’s clinical development. TipRanks data shows that financial blogger opinions are 81% Bullish on LLY, compared to a sector average of 71%.

Bottom-Line

With decent analyst ratings, positive clinical developments, and stock price performance as factors in consideration, investors might cautiously invest in this stock.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

Moderna’s New CFO Departs on Legal Issues

Dutch Bros Fizzes Out on Surprise Quarterly Loss

Pfizer & Biohaven Combine Forces; Vying for Valuable Upside