While Tempest Therapeutics (NASDAQ:TPST) isn’t known for much right now, this biotech stock still managed to gain over 13% in Thursday afternoon’s trading. The biggest reasons are connected to new potential partnership arrangements as well as an improved cash runway that should buy time for new developments.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Much of the news for Tempest lately has had little to do with anything it’s got in development, though it does have some fairly impressive developments in the works. That’s particularly true for anyone who’s got liver cancer. For now, however, most of the developments focused on improvements to its cash runway, which is now said to extend well into 2025. It’s also looking into some new partnership arrangements that might further pad Tempest’s coffers and give it the necessary time to get a drug to market and make itself a break-even concept at least.

But it turns out there was more to see here than just a few money moves. There was also new word on TPST-1120, its liver cancer treatment. Old analyses were actually improved, reports note, including new biomarkers that “…effectively rescue…the standard of care in PD-L1 negative patients.” Further, those liver cancer patients with a “b-catenin mutation” also had little cause for alarm, as there’s an improved response rate under those conditions. TPST-1120 already showed some promise when it was backed up by other drugs from Roche, and it was moving into a “pivotal study” as things were. It might be getting closer to a ready treatment, and that could really help Tempest out substantially.

Is TPST a Good Stock to Buy?

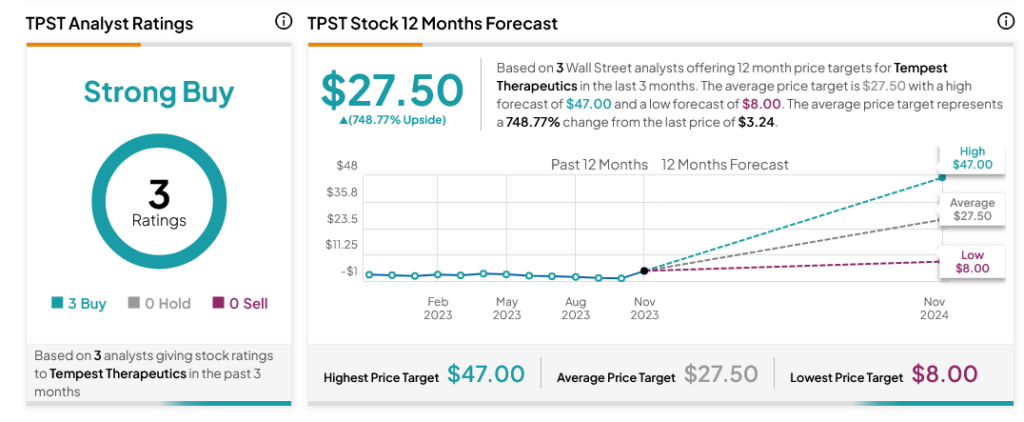

Turning to Wall Street, analysts have a Strong Buy consensus rating on TPST stock based on three Buys assigned in the past three months, as indicated by the graphic below. Furthermore, the average TPST price target of $27.50 per share implies 748.77% upside potential.